Rule 3 – Main rule-Location of the service receiver :

The place of provision of a service shall be the location of service receiver.

However, in case the location of the service receiver is not available in the ordinary course of business, the place of provision shall be the location of the service provider.

(A) ANALYSIS OF THE MAIN RULE: The default rule provides that a service shall be deemed to be provided where the service receiver is located. The main rule would apply when none of the later rules apply. Thus, if a service is not covered by an exception under one of the later rules, and is consequently covered under this default rule, then the receiver’s location will determine whether the service is leviable to tax in the taxable territory.

Note: The address of the service receiver should be available in the ordinary course of business and the service provider is not required to make any extraordinary efforts to trace his address.

Place of provision to be the location of the service provider if the location of receiver is not ascertainable in the ordinary course of business

Generally, in case of a service provided to a person who is in business, the service provider will have the location of the recipient‟s registered location, or his business establishment, or his fixed establishment etc, as the case may be.

However, in case of certain services (which are not covered by the exceptions to the main rule), the service provider may not have the location of the service receiver, in the ordinary course of his business. This will also be the case where a service is provided to an individual customer who comes to the premises of the service provider for availing the service and the provider has to, more often than not, rely on the declared location of the customer. In such cases, the place of provision will be the location of the service provider.

(B) IMPLICATION OF THE RULE

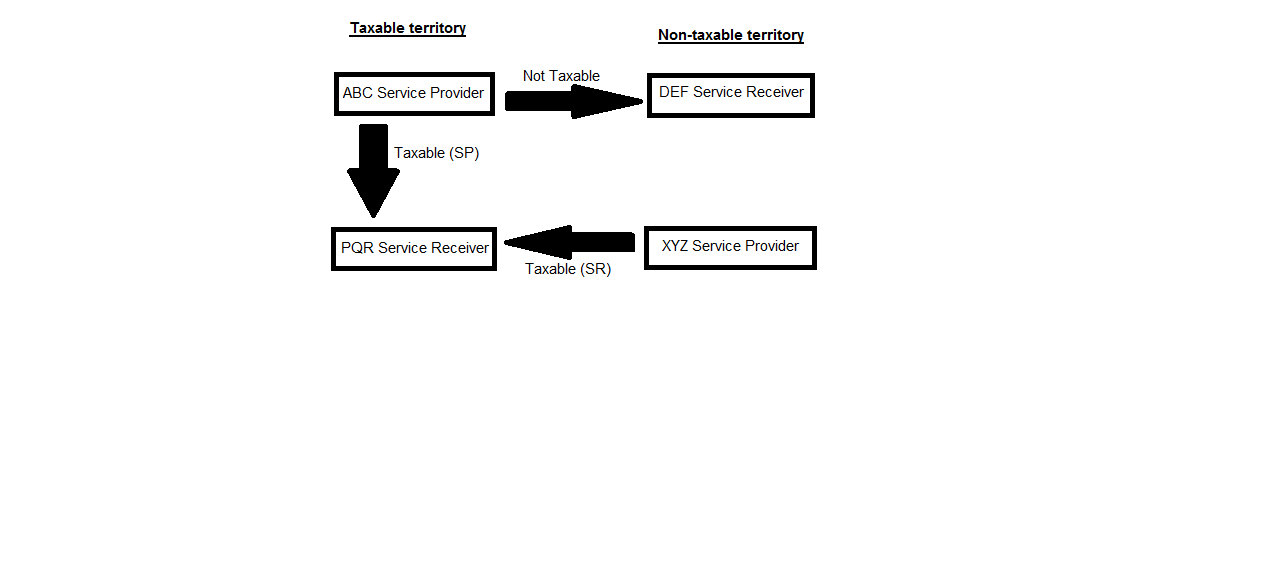

(i) Where the location of receiver of a service is in the taxable territory, such service will be deemed to be provided in the taxable territory and service tax will be payable.

(ii) Where the location of receiver of a service is outside the taxable territory, no service tax will be payable on the said service.

Under normal circumstances, a service provider is liable to pay service tax. However, if he is located outside the taxable territory and the place of provision of service is in the taxable territory, the person liable to pay service tax is service receiver in the taxable territory.