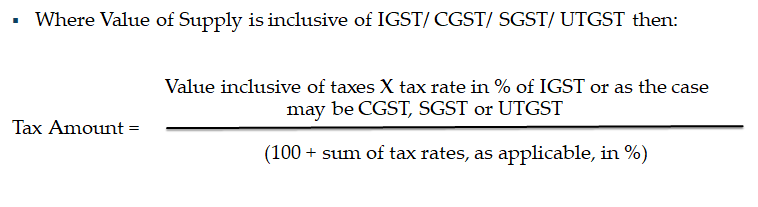

Rule 35: Value of supply inclusive of integrated tax, central tax, State tax, Union territory tax

Illustrations :

- Mr. Mohan located in Manipal purchases 10,000 Hero ink pens worth Rs.4,00,000 from Lekhana Wholesalers located in Bhopal. Mr. Mohan’s wife is an employee in Lekhana Wholesalers. The price of each Hero pen in the open market is Rs.52. The supplier additionally charges Rs.5,000 for delivering the goods to the recipient’s place of business.

- Ans. Mr. Mohan and Lekhana Wholesalers would not be treated as related persons merely because the spouse of the recipient is an employee of the supplier, although such spouse and the supplier would be treated as related persons. Therefore, the transaction value will be accepted as the value of the supply. The transaction value includes incidental expenses incurred by the supplier in respect of the supply up to the time of delivery of goods to the recipient. This means, the transaction value will be: Rs.4,05,000 (i.e., 4,000,000 + 5,000).

- Sriram Textiles is a registered person in Hyderabad. A particular variety of clothing has been categorised as non-moving stock, costing Rs.5,00,000. None of the customers were willing to buy these clothes in spite of giving big discounts on them, for the reason that the design was too experimental. After months, Sriram Textiles was able to sell this stock on an online website to another retailer located in Meghalaya for Rs.2,50,000, on the condition that the retailer would put up a poster of Sriram Textiles in all their retail outlets in the State.

- Ans. The supplier and recipient are not related persons. Although a condition is imposed on the recipient on effecting the sale, such a condition has no bearing on the contract price. This is a case of distress sale, and in such a case, it cannot be said that the supply in lacking ‘sole consideration’. Therefore, the price of Rs.2,50,000 will be accepted as value of supply.

- Rajguru Industries stock transfers 1,00,000 units (costing Rs.10,00,000) requiring further processing before sale, from Bijapur in Karnataka to its Nagpur branch in Maharashtra. The Nagpur branch, apart from processing units of its own, engages in processing of similar units by other persons who supply the same variety of goods, and thereafter sells these processed goods to wholesalers. There are no other factories in the neighbouring area which are engaged in the same business as that of its Nagpur unit. Goods of the same kind and quality are supplied in lots of 1,00,000 units each time, by another manufacturer located in Nagpur. The price of such goods is Rs.9,70,000.

- Ans.: In case of transfer of goods between two registered units of the same person (having the same PAN), the transaction will be treated as a supply even if the transfer is made without consideration, as such persons will be treated as ‘distinct persons’ under the GST law. The value of the supply would be the open market value of such supply. If this value cannot be determined, the value shall be the value of supply of goods of like kind and quality. In this case, although goods of like kind and quality are available, the same may not be accepted as the ‘like goods’ in this case would be less expensive given that the transportation costs would be lower. Therefore, the value of the supply would be taken at 110% of the cost, i.e., Rs. 11,00,000 (i.e., 110% * 10,00,000).

- M/s. Monalisa Painters owned by Vasudev is popularly known for painting the interiors of banquet halls. M/s. Starry Night Painters (also owned by Vasudev) is engaged in painting machinery equipment. A factory contracts M/s. Monalisa Painters for painting its machinery to keep it from corrosion, for a fee of Rs.1,50,000. M/s. Monalisa Painters sub-contracts the work to M/s. Starry Night Painters for Rs.1,00,000, and ensures supervision of the work performed by them. Generally, M/s/ Starry Night Painters charges a fixed sum of Rs.1,000 per hour to its clients; it spends 120 hours on this project.

- Ans.: Since M/s. Monalisa Painters and M/s. Starry Night Painters are controlled by Mr. Vasudev, the two businesses will be treated as related persons. Therefore, Rs.1,00,000 being the sub-contract price will not be accepted as transaction value. The value of the service would be the open market value being Rs. 1,20,000 (i.e., Rs. 1,000 per hour * 120 hours) *.

- Note: This view is based on the grounds that there are no comparable to this supply.

- Prestige Appliances Ltd. (Bangalore) has 10 agents located across the State of Karnataka (except Bangalore). The stock of chimneys is dispatched on Just-In-Time basis from Prestige Appliances Ltd. to the locations of the agents, based on receipt of orders from various dealers, on a weekly basis. Prestige Appliances Ltd. is also engaged in the wholesale supply of chimneys in Bangalore. An agent places an order for dispatch of 30 chimneys on 22-Sep-2017. Prestige had sold 30 chimneys to a retailer in Bangalore on 18-Sep-2017 for Rs. 2,80,000. The agent effects the sale of the 30 units to a dealer who would effect the sales on MRP basis (i.e., @ Rs.10,000/unit).

- Ans.: The law deems these supplies between the principal and agent to be supplies for the purpose of GST. Therefore, the transfer of goods by the principal (Prestige) to its agent for him to effect sales on behalf of the principal would be deemed to be a supply although made without consideration. The value would be either the open market value, or 90% of the price charged by the recipient of the intended supply to its customers, at the option of the supplier. Thus, the value of the supply by Prestige to its agent would be either Rs. 2,80,000, or 2,70,000 (i.e., 90%*10,000 * 30), based on the option chosen by Prestige.

- Mr. & Ms. Mehta purchase 10 gift vouchers for Rs. 500 each from Crossword, and 5 vouchers from Four Fountains Spa costing Rs. 1,000 each, and gives them as return gifts to children and their parents for their son’s birthday party. The vouchers from Four Fountains Spa had a special offer for couples – services for both persons at the price chargeable to one.

- Ans. The value of the supply would be the money value of the goods redeemable against the voucher. Thus, in case of vouchers from Crossword, the value would be Rs. 5,000 (i.e., Rs.500 * 10) and the value of vouchers in case of Four Fountains Spa would be Rs. 10,000 (i.e., Rs. 1,000 * 2 * 5).