Rule 5B – Refund of CENVAT credit to service providers providing services taxed on reverse charge basis :

A service provider rendering services notified under section 68(2) of the Finance Act (services taxed on reverse charge basis) and being unable to utilise the CENVAT credit availed on inputs and input services for payment of service tax on such output services, shall be allowed refund of such unutilised CENVAT credit. The procedure, safeguards, conditions and limitations to which such refund shall be subject to have been prescribed by CBEC vide Notification No. 12/2014 CE (NT) dated 03.03.2014 as under:

A. SAFEGUARDS, CONDITIONS AND LIMITATIONS

(a) Refund is admissible, of unutilised CENVAT credit taken on inputs and input services during the half year for which refund is claimed, for providing following output services:

(i) renting of a motor vehicle designed to carry passengers on non-abated value, to any person who is not engaged in a similar business;

(ii) supply of manpower for any purpose or security services; or

(iii) service portion in the execution of a works contract;

(hereinafter above mentioned services will be termed as partial reverse charge services).

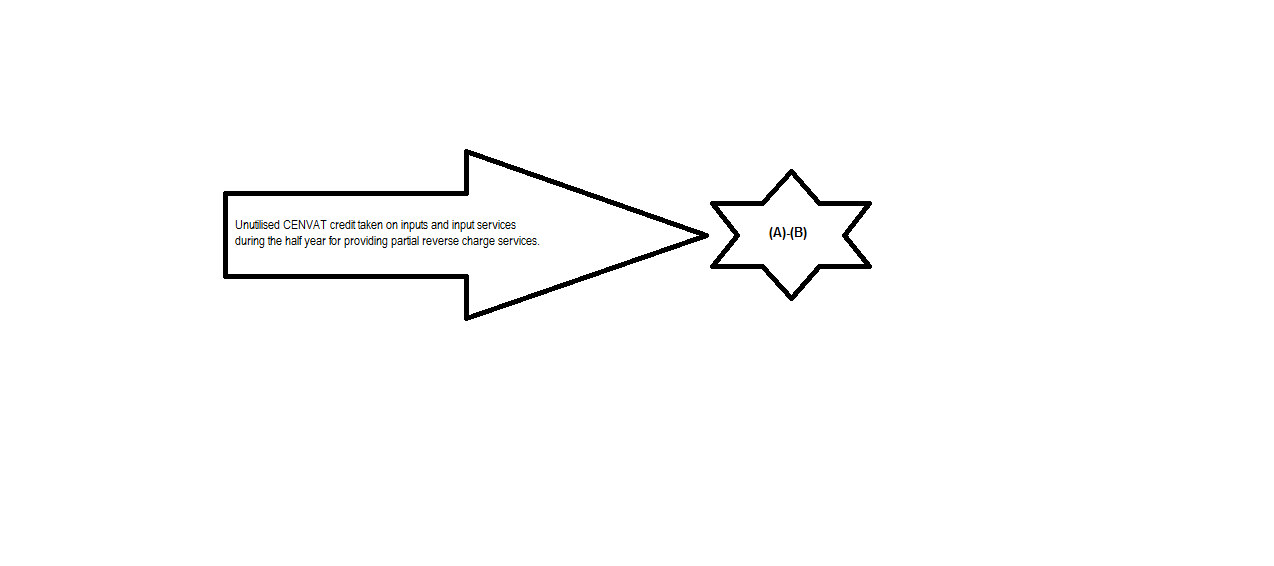

The amount of refund would be computed as follows

Where

A = CENVAT credit taken on inputs and input services during the half year × Turnover of output service under partial reverse charge duirng the half year / Total turnover of goods and services during the half year

B = Service tax paid by the service provider for such partial reverse charge services during the half year.

(b) Refund shall not exceed the amount of service tax liability paid/payable by the service receiver with respect to the partial reverse charge services provided during the period of half year for which refund is claimed.

(c) Amount claimed as refund shall be debited by the claimant from his CENVAT credit account at the time of making the claim. However, if the amount of refund sanctioned is less than the amount of refund claimed, then the claimant may take back the credit of the difference between the amount claimed and the amount sanctioned.

(d) The claimant shall submit not more than one claim of refund under this notification for every half year.

(e) Refund claim shall be filed after filing of service tax return for the period for which refund is claimed.

Half year means a period of six consecutive months with the first half year beginning from the 1st day of April every year and second half year from the 1st day of October of every year.

B. PROCEDURE FOR FILING THE REFUND CLAIM

(a) The output service provider shall submit an application in Form A, along with specified documents and enclosures, to jurisdictional Assistant Commissioner/Deputy Commissioner, before the expiry of 1 year* from the due date of filing of return for the half year. Copies of return(s) filed for the said half year shall also be filed along with the application.

*In case of more than one return required to be filed for the half year, 1 year shall be calculated from due date of filing of the return for the later period.

(b) The Assistant Commissioner/Deputy Commissioner, may call for any document in case he has reason to believe that information provided in the refund claim is incorrect or insufficient and further enquiry needs to be caused before the sanction of refund claim, and shall sanction the claim after satisfying himself that the refund claim is correct and complete in every respect.