Rules for Debiting and Crediting :

In actual practice, the individual transactions of similar nature are recorded, added and substracted at one place. Such place is customarily the meaning of debit and credit, it is essential to understand the meaning and form of an account.

An account is a record of all business transactions relating to a particular person or asset or liability or expense or income. In accounting, we keep a separate record of each individual, asset, liability, expense or income. The place where such a record is maintained is termed as an ‘Account’.

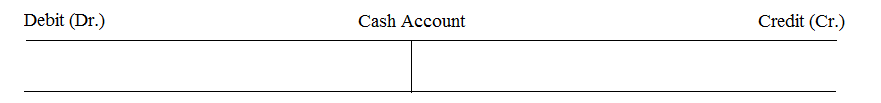

All accounts are divided into two sides. The left hand side of an account is called Debit side and the right hand side of an account is called Credit side. In the abbreviated form Debit is written as Dr. and Credit is written as Cr. For example, the transactions relating to cash are recorded in an account, entitled ‘Cash Account’ and its format will be as given below:

In order to decide when to write on the debit side of an account and when to write on the credit side of an account, there are two approaches. They are: 1) Accounting Equation Approach, 2) Traditional Approach.

Nature of Account

The accounting equation is a statement of equality between the debits and the credits. The rules of debit and credit depend on the nature of an account. For this purpose, all the accounts are classified into the following five categories in the accounting equation approach:-

1. Assets Accounts

2. Capital Account

3. Liabilities Accounts

4. Revenues or Incomes Accounts

5. Expenses or Losses Accounts

If there is an increase or decrease in one account, there will be equal decrease or increase in another account. Accordingly, the following rules of debit and credit in respect of the various categories of accounts can be obtained.

The rules may be summarised as below :-

1. Increases in assets are debits;

decreases in assets are credits.

2. Increases in capital are credits;

decreases in capital are debits.

3. Increases in liabilities are credits;

decreases in liabilities are debits.

4. Increases in incomes and gains are credits;

decreases in incomes and gains are debits.

5. Increases in expenses and losses are debits;

decreases in expenses and losses are credits.

| Elements of Accounting Equation |

Debit | Credit |

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Capital | Decrease | Increase |

| Revenues | Decrease | Increase |

| Expenses | Increase | Decrease |

In the traditional approach, all the accounts are classified into the following three types.

1. Personal Accounts 2. Real Accounts 3. Nominal Accounts

Golden Rules for Debit and Credit:

| 1. Personal Accounts – | a) Debit the receiver |

| b) Credit the giver | |

| 2. Real Accounts – | a) Debit what comes in |

| b) Credit what goes out | |

| 3. Nominal Accounts – | a) Debit all expenses and losses |

| b) Credit all incomes and gains |