RULES OF DEBIT AND CREDIT :

The left hand side of an account is called the debit side; while the right hand side is called the credit side. An entry on the left side of an account is called a debit entry, or merely a debit, an entry on the right side is called a credit entry or credit. The act of recording an entry on the left side of an account is called debiting the account; and recording an entry on the right side of an account is called crediting the account. The difference between the total debits and total credits in an account is the account balance. Double entry system means the recording of both the aspects i.e. debit and credit

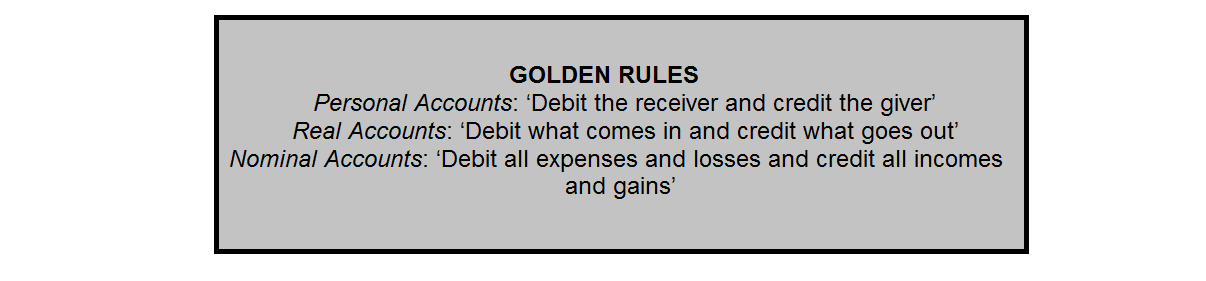

Personal Accounts: ‘Debit the receiver and credit the giver’, i.e. debit the account of the person who receives something and credit the account of the person who gives something. For example, if you purchase goods from Ram on credit, the two accounts involved are Goods (Purchase) Account and Ram’s Account. The latter account is a personal account. Since, Ram is the giver in this transaction, his account will be credited. Similarly, if cash is paid to Ram, Ram’s Account will be debited since he is the receiver. Thus, the account of a person is debited with any benefit such person receives and is credited with any benefit such person imparts.

Real Accounts: ‘Debit what comes in, and credit what goes out’, i.e. debit the account of the thing which comes in and credit the account of the thing which goes out. For example, where furniture is purchased for cash, furniture account is debited while cash account is credited.

Nominal Accounts: ‘Debit all expenses and losses and credit all incomes and gains’ i.e. debit the accounts of expenses and losses and credit all incomes and gains. For example, if firm/business pays salary to its clerk, the two accounts involved are salary account and cash account. Salary account is a nominal account. Salary paid is an expense of the business and therefore this account will be debited. Similarly if interest is received, interest account will be credited, since interest is an income item.