Salary or Commission to Partners:

Some partners may devote more time or possess better skills and experience in comparison with their fellow partners. As a result, they

should be allowed a special compensation either in the form of salary or commission.

Commission may be allowed as a percentage of net profit before charging the commission or after charging the commission. Commission, under the two methods, is computed as under

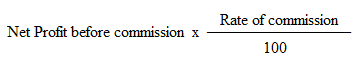

i) Percentage of Net profit before charging such commission

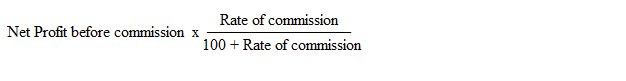

ii) Percentage of Net profit after charging such commission

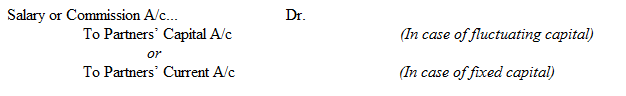

The accounting entries to be passed to adjust salary or commission :

a) To adjust salary or commission to a partner

b) To close the salary or commission account: