Sanction for issue of notice [Section 151] :

(i) Section 151 requires the Assessing Officer to obtain sanction from certain authorities before issue of notice for reassessment of income under section 148, under certain specified circumstances.

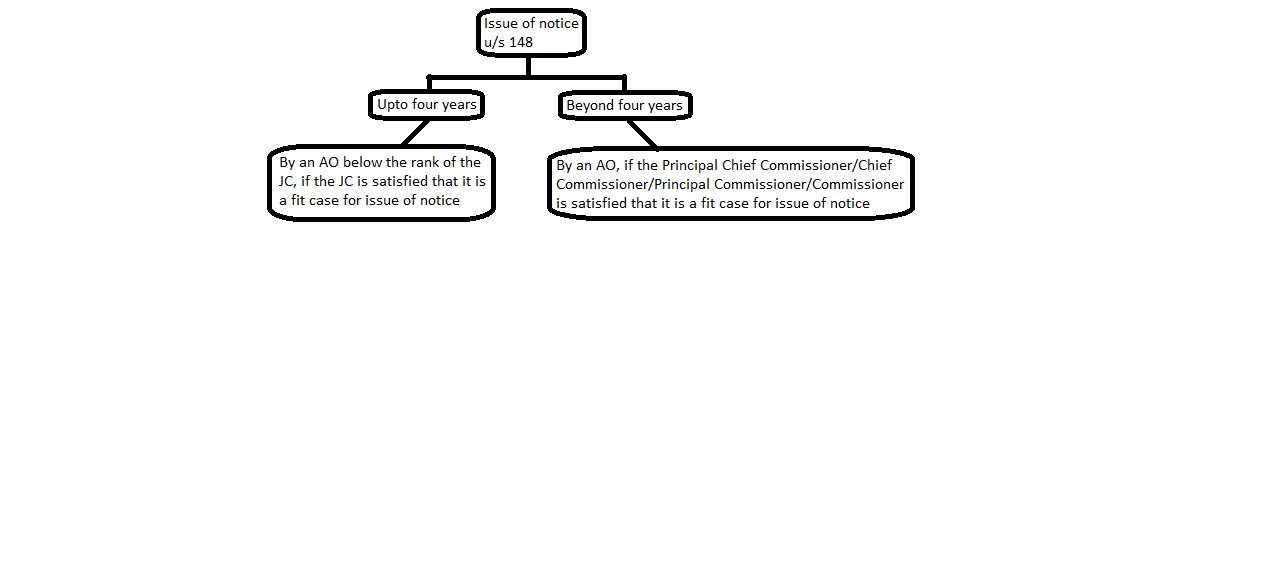

(ii) The simplified approval regime with effect from 1.6.2015 for issue of notice for reassessment is given hereunder –

| Time limit (from the end of the relevant A.Y.) | Issue of Notice under section 148 by | Competent authority who has to be satisfied on the reasons recorded by the A.O., that it is a fit case for the issue of such notice | |

| (1) | Upto 4 years | Assessing Officer below the rank of Joint Commissioner | Joint Commissioner |

| (2) | After 4 years | Assessing Officer | Principal Chief Commissioner/ Chief Commissioner/Principal Commissioner/ Commissioner |

It is further clarified that in the above cases, the Principal Chief Commissioner or Chief Commissioner or the Principal Commissioner or Commissioner or the Joint Commissioner, as the case may be, has to be satisfied on the reasons recorded by the Asses sing Officer about fitness of a case for the issue of notice under section 148. However, these authorities are not required to issue the notice themselves.