Section 16

(a) Registered person to avail credit: Every registered person subject to Section 49 (payment of tax), shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business. The input tax credit is credited to the electronic credit ledger. Rule 36 of the Central Goods and Service Tax Rules, 2017 provides that input tax credit can be taken on the basis of any of the following documents:

(i) Invoice issued under section 31 by supplier of goods or services.

(ii) Debit note issued under section 34 by supplier of goods or services.

(iii) Bill of entry or any similar documents under Custom Act, 1962.

(iv) Invoice prepared in respect of supplies made under reverse charge basis issued u/s 31(3)(f).

(v) Invoice/ Credit Note issued by ISD for distribution of credit in accordance with Rule 54(1) of CGST Rules, 2017.

It is important to observe the words ‘used by him’ and ‘in his business’ as appearing in section 16(1). These words refer to the registered taxable person in question and not the legal entity. So, input tax paid in a State must not be in relation to the business of a taxable person in another State, albeit belonging to the same person. For example, A Company has Branch-A which is a registered taxable person in Andhra Pradesh conducts conference in a hotel in Lonavla (Maharashtra) where CGST-SGST is charged by the hotel. This Company also has Branch-M which is a registered taxable person in Mumbai, Now the provisions of section 16(1) operate as follows:

CGST-SGST charged by the hotel in Lonavla (Maharashtra) is ‘used in the business of Branch-A’ in Andhra Pradesh and not in the business of Branch-M in Mumbai.

Hotel would not be aware about the above fact and would not resist to issue the bill in the name of Branch-M because both are branches of the same Company

Since, CGST-SGST has been charged by the hotel, input tax credit would not be available to Branch-A as tax paid in Maharashtra is not a creditable tax in Andhra Pradesh

Branch-M may be compelled to forego the tax paid to the hotel. However, there may be an urge to save this loss by providing the GSTIN of Branch-M to the hotel. In fact, the Company is rightly required to obtain ISD registration in Maharashtra and distribute this credit entirely to Andhra Pradesh.

But, Branch-M in Mumbai cannot justify this input tax credit as it is not ‘used by him’ in ‘his business’ but it is ‘used by another’ in ‘that others business’

Care should to taken to verify ‘whose’ business each input tax credit relates to;

If nexus is established between the services of the hotel and the ‘business’ of Branch-M, input tax credit may be availed by Branch-M. Nexus emerges if interbranch supply of services occurs between Branch-M and Branch-A

Alternatively, based on the amount of credits of Branch-A lying as CGST + MGST credits, the company may decide to obtain ISD registration in the State of Maharashtra and transfer the credits as IGST from Maharashtra to Andhra Pradesh

(b) Wastage of inputs in the course of production: Credit in respect of inputs that may have been wasted during the course of production of finished products does not cease to be ‘used or intended to be used’ in the course or furtherance of business. As such, there is no restriction to read into the language of section 16 (1). In fact, the full extent of credit would be available whether the extent of wastage of inputs in the course of production of finished goods is within normal wastage norms or even exceeds that to be called abnormal wastage of inputs. Unless there is a diversion of inputs (in respect of which credit has been availed), there is no embargo on availment and retention of input tax credit. Section 17(5)(h) restricts credit on “goods lost” since these can no longer be used for the purpose of business but does not provide for restriction of credits on “loss of goods” which could be a process loss inherent to the nature of product on which credit has been availed. Therefore , “goods lost” must be given a completely different meaning as compared to “goods lost during production / process or a normal / abnormal loss”.

(c) Input-Output nexus: The erstwhile CENVAT Credit Rules, 2004 allowed for credits on input and input services used for manufacture of excisable goods or for rendering taxable services. The credit under GST law is available on procurements which are “used” or “intended to be used” in the course or furtherance of business. Hence, any procurements though not having any remote connection with the manufacturing or rendering of outward supplies, would also qualify for input tax credit so long as it is sed or intended to be used for the purpose of business. Eg. Air Conditioner installed in the cabin of the Managing Director, Maharashtra has no correlation with the car manufactured at the Company Plant in Gujarat but the credit of tax relating to such air conditioner would be available since the air conditioner has been installed for the purpose of business.

(d) Costing-pricing inter-relationship: Credit may be availed in respect of inputs whose cost may not be included in the pricing of the product and consequently, not included in the transaction value – this may create a concern as to whether this credit is admissible or not. As explained by the Hon’ble Supreme Court in CCE, Pune v. Dai Ichi Karkaria 1999 (112) ELT 353, the nature of Modvat scheme is such that the cost of purchase of inputs lowered due to availment of credit, does not immediately, directly and proportionately impact the assessable value of the finished product manufactured using the inputs. The ratio of this judgement must be understood to continue to be applicable in the context of GST law, as well. As such, neither availment of credit nor its discontinuation can be alleged to have an immediate, direct and proportionate effect on the transaction value under section 15. However, the implications under Anti Profiteering provisions of the GST Law should be borne in mind while deciding on the pricing and net benefit of tax due to introduction of GST.

(e) Time limit to avail the input tax credit: A registered person is not entitled to avail input tax credit on tax invoice/ debit notes after the due date of furnishing of the return under section 39 for the month of September of the subsequent financial year or furnishing of the relevant annual return, whichever is earlier. In fact, not only is registration a pre-requisite (see, ‘registered taxable person’ shall be entitled to claim credit) but filing of return under section 39 is also a requirement. Input tax credit is a right that does not ‘vest’ until the last of conditions in section 16(2) are fulfilled. Until then, this right i.e., input tax credit is inchoate (or incomplete or in-formation) and not a vested right. Rights that are not yet vested can lapse by limitation unless effective steps to actualize those rights are taken by the person. And once the right stands vested, it becomes indefeasible except by operation of subsequent inherent conditions. In other words, input tax credit which is a right in law of the taxable person is not fully matureand is not available to the taxable person until all pre-conditions (steps to actualize available rights) have been taken. Section 16(2) lays down these steps that can be taken immediately or in course of time. And once all these steps are taken then the right i.e ‘available’ becomes a right that can be ‘availed’. After the credit stands availed, it is available without any time limit. Section 18(4) provides a condition (known at the time of availing credit) that this credit will be reversed if the outward supplies become exempted. Other than this situation, the credit availed is permanently available to thetaxable person. Now, in a situation where the credit that is ‘available’ is somehow delayed and ‘not availed’, it would still be available but not beyond the limitation prescribed in Section 16(4). Once the limitation prescribed in section 16(4) sets in, the credit which is ‘not availed’ by virtue of the limitation prescribed is proper in view of the principle of reaching finality in respect of all ‘available’ credits that may ‘not’ be intended to be availed. Therefore in case of doubts one can avail the credit and then reverse under protest under intimation to revenue. This would ensure that the time limitation would not be the reason for non availment once clarity emerges from Courts.

(f) Deemed receipt of goods: Section 16 permits a registered person to avail credit only after he has received the said goods or services or both. However, in case of bill to-ship to transactions (including where such goods are sent for job work), by which the registered person instructs his supplier to ship the goods to another person on his behalf, the date of receipt of goods by such another person shall be deemed to be the date of receipt of goods by the said registered person.

Therefore what exactly does ‘received’ mean in this context? Does it refer to actual receipt of goods at factory premises or even constructive receipt of goods would suffice? Broadly, receipt of goods may be said to be complete when goods have been supplied as per the recipient’s instructions and the supplier is discharged from any further liability on such goods. The delivery must be complete in all respects to the utmost satisfaction of the recipient. The point of acceptance in cases of pre requisite of quality control may have to be clear.

For example, an interesting scenario may be encountered when goods imported by a registered person are supplied directly to his customers in India from the port without bringing such imported goods (physically) to his factory premises. Would the importer still be entitled to ITC of IGST paid on imported goods although such goods were never received at his factory premises? The answer is ‘Yes’. The importer, after fulfilling all the import formalities is deemed to have received the goods and thus, eligible to avail input tax credit of IGST paid on imports.

(g) Goods received in instalments: If goods are received in instalments against a single invoice, credit can be availed upon receipt of last instalment of goods. Illustration – A consignment of coal is to be dispatched from Kolkata to Mumbai using five trucks. An invoice was issued to the recipient on March 30, 2018. Four trucks reached the claimant by March 30, 2018 but the truck carrying he final lot of the consignment reached the recipient only on April 2, 2018. In this case, input tax credit for the entire consignment can be availed only in the month of April 2018.

(h) Receipt of Services: The recipient can claim credit only upon receipt of services. In the commercial world, while it is easy to demonstrate receipt of goods (by way of physical stock, e-way bill, GRN etc), the same is not to be in case of services which is an intangible in nature. Determination of actual receipt of services could be a formidable task especially when the contracting period for provision of service extends beyond a tax period but consideration is received in advance. .

(i) Failure to pay to supplier of goods or service or both, the value of supply and tax thereon: Where the recipient of goods or services or both have failed to pay the supplier within 180 days from date of invoice, input tax credit availed, in proportion to such unpaid consideration shall be added to the recipient’s output tax liability along with interest as may be applicable. Such non-payment of the value of invoice must be disclosed in FORM-GSTR 2 filed for the month immediately following the expiry of 180 days from the date of issue of invoice. However, such input tax credit may be reclaimed as and when the unpaid amount (including taxes) is subsequently paid. One may note that this condition shall not apply to supplies that are liable to tax under reverse charge and supplies made without consideration as specified in Schedule I.Conspicuous by its absence within this carved out provision is the import of goods. While reverse charge is excluded from the condition of having to make payment within 180 days, GST paid on import of goods does not fall within the ambit of reverse charge under section 9(3) or 9(4) of the CGST Act or Section 5(3) or Section 5(4) of the IGST Act although IGST paid on import of goods is akin to reverse charge. The question that now arises is – whether there can be reverse charge liability other than under section 9(3) and 9(4). The definition in section 2(98) does not permit such extended application. The privilege to prescribe pre-conditions for vesting of right to input tax credit belongs to section 16 and therefore, there is no other provision from where any overriding right to claim credit on goods imports may be borrowed or imputed. On the other hand, IGST paid under reverse charge on import of services is covered under Section 5(3) of the IGST Act as a result of which an importer of service would be entitled to credit of IGST paid even if the service provider remains unpaid beyond the said period of 180 days. One may however wonder the need for such a provision under the GST law, given the fact that payment of consideration is a private arrangement between the parties to the contract. The Government is needlessly meddling with contractual payment terms by dangling the sword of ITC reversal over the neck of the recipient of supply. The fact that the Government receives its tax when time of supply is triggered irrespective of when consideration is actually paid, adequately protects the interest of revenue thus failing to justify the need for such a provision.

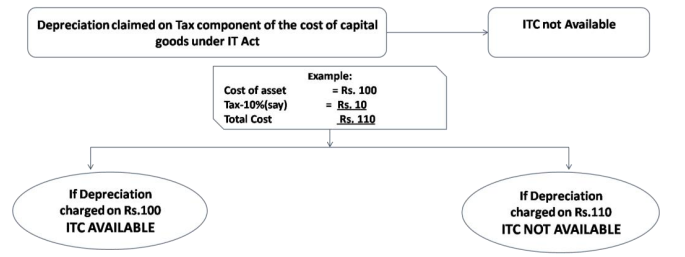

(j) Capital goods on which depreciation is claimed: Input tax credit shall not be allowed on the tax component of the cost of capital goods and plant and machinery if depreciation on such tax component has been claimed under the provisions of the Income Tax Act, 1961.

There may however, be instances where an assessee is unable to avail input tax credit on capital goods for various reasons, say for example, the department has objected to it. In such cases, assessee may decide to capitalize the tax component and avail depreciation on tax component also. Whenever the dispute relating to eligibility of input tax credit on capital goods is resolved, assessee may avail Input Tax Credit and correspondingly reverse the depreciation claimed under Income Tax Act, 1961 on tax component. Similar provisions existed under CENVAT Credit Rules and the Hon’ble Gujrat High Court in the case Genus Electrotech Limited reported in 2013 (296) ELT 175 (Guj.) held that after reversal of entry for deprecation, assessee could avail credit. The ratio of this decision under the CENVAT Credit Rules, 2004 will equally hold good under the GST law since the provisions are similar. Although, there was no time limit for availing tax credit on capital goods under the CENVAT Credit Rules, 2004, under the GST law, credit cannot be availed after the due date of filing the returns for the month of September following the end of the financial year or the date of filing the annual return, whichever is earlier. It would be worthwhile to note that Rule 37(4) which provides for re-availment of input tax credit for an unrestricted period is applicable only in respect of ITC reversed earlier for non-payment of consideration to the supplier within 180 days and not for re-claim of ITC on account of reversal of depreciation as discussed above. It may be interesting to note that Section 16(3) states that input tax credit shall not be llowed in cases where depreciation has been claimed on “the tax component of thecost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961.” The use of the words plant and machinery in addition to ‘capital goods’ requires special attention. Capital Goods have been defined to mean goods used or intended to be used in the course or furtherance of business, the value of which has been capitalised in the books of account. Going by the above definition, ‘Plant and machinery’ in respect of which depreciation is to be claimed would per se fall within the ambit of capital goods as defined above. This special mention of ‘plant and machinery’ in addition to capital goods may be interpreted to mean that merely charging the value of plant and machinery (including the tax component thereof) to the Profit and Loss account could invalidate the claim of the registered person to input tax credit even though the asset (i.e., Plant and Machinery) has not been capitalised. The intention should be that what is not “revenue” in nature only can be capitalised and therefore whatever is not capitalised would be eligible. It appears that this contentious issue would only stand resolved over time.

In summary, among others the following facts are crucial for availment of Input tax credit:

(a) The claimant should be registered under the GST Law to avail the input tax credit (except for certain exceptions covered under Section 18)

(b) The goods and/ or services must be used “by him” in the course or furtherance “of his” business.

(c) Possession of original tax Invoice/Supplementary Invoice/ Debit note/ ISD invoice/ Bill of Entry and other related documents is a must.

(d) The said document must contain all the particulars prescribed / specified in Rule 46 ofCentral Goods and Service Tax Rules, 2017 relating to a Tax Invoice. It may be noted that the Tax Invoice or such other document can contain additional details other than those prescribed but NO LESS. For details of invoice, see Chapter VI of the CGST Rules.

(e) Supplier of goods and/ or services must upload the details of such documents in the common portal i.e. GSTN. Subject to section 41 being claim of ITC and provisional acceptance thereof, the supplier must have remitted the tax charged on such supplies.

(f) Vesting condition for claiming input tax credit is the return u/s 39 and not the supply per se.

(g) The claimant should have received the goods / services. Input tax credit in case of supplies in installment, would be on receipt of last installment of goods.

(h) The law casts an obligation on the recipient of supply availing credit to effect payment to the supplier within a period of 180 days from the date of invoice. If such payment is not effected/ partially effected by the recipient to the supplier, Rule 37 obligates reversal/ proportionate reversal of input tax credit so availed leading to consequential levy of tax and interest.

Proviso to section 16(2) provides that the taxable person shall be entitled to avail input tax credit after making payment of the amount towards value of supply of goods or services or both along with tax payable thereon. Further, Rule 37(4) provides that the time limit specified under section 16(4) shall not be applicable for such recredit.

(i) Claim of depreciation on the GST component disqualifies a recipient of Capital goods and plant and machinery from availment of input tax credit.

(j) ITC cannot be availed after the due date of filing the return for September month of the next financial year or on furnishing the Annual Return whichever is earlier.

(k) No registered person is permitted to avail any input tax credit pursuant to an order of demand on account of fraud, willful misstatement, or suppression of fact.Note: The last point is important as many of the cases in a routine manner the show cause notice would invoke these mala fide intentions and if not contested, the ITC would not be available to the receiver even if otherwise eligible.