GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(Department of Revenue)

Notification No. 41/2017

-Central Tax (Rate)

New Delhi, the 14th November, 2017

G.S.R. (E).- In exercise of the powers conferred by sub-section (1) of section 9 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.1/2017-Central Tax (Rate), dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 673(E), dated the 28th June, 2017, namely:-

In the said notification,-

(A) in Schedule I – 2.5%,-

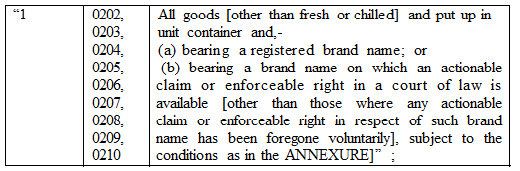

(i) for S. No. 1 and the entries relating thereto, the following shall be substituted, namely: –

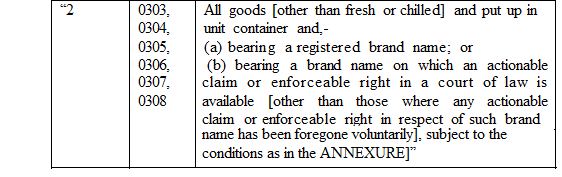

(ii) for S. No. 2 and the entries relating thereto, the following shall be substituted, namely:-

(iii) S. Nos. 3,4,5, 6 and the entries relating thereto shall be omitted;

(iv) in S. No. 16, for the entry in column (3), the entry “All goods [other than fresh or chilled] and put up in unit container and, –

(a) bearing a registered brand name; or

(b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE”, shall be substituted;

(v) in S. No. 23, in the entry in column (3) , after the word “frozen”, the words “, put up in unit container and,-

(a) bearing a registered brand name; or

(b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE”, shall be inserted;

(vi) in S. No. 26, for the entry in column (3), the entry “Manioc, arrowroot, salep, Jerusalem artichokes, sweet potatoes and similar roots and tubers with high starch or inulin content, frozen, whether or not sliced or in the form of pellets, put up in unit container and,-

(a) bearing a registered brand name; or

(b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE”, shall be substituted;

(vii) in S. No. 27, for the entry in column (3) ,the entry “Cashew nuts, whether or not shelled or peeled, desiccated coconuts ” shall be substituted;

(viii) in S. No. 30, in the entry in column (3) , after the words “shelled or peeled”, the words “,put up in unit container and,-

(a) bearing a registered brand name; or

(b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim

or

enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE”, shall be inserted;

(ix) in S. No. 58, in the entry in column (3) , after the words “Meal, powder,” the words “Flour” , shall be inserted;

(x) S. No. 60 and the entries relating thereto shall be omitted;

(xi) in S. No. 66, in column (3), the words, “other than of seed quality” shall be omitted;

(xii) for S. No. 72 and the entries relating thereto, the following shall be substituted, namely:-

72 |

1210 20 00 |

Hop cones, ground, powdered or in the form of pellets; lupulin” ;

|

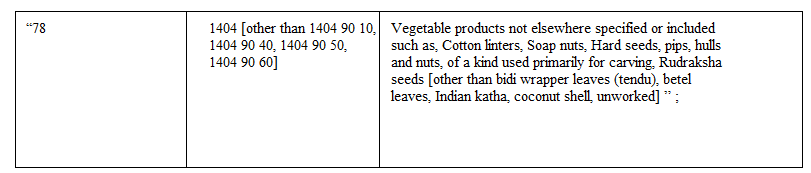

(xiii) for S. No. 78 and the entries relating thereto, the following shall be substituted, namely:-

(xiv) ) in S. No. 91, in column (3), the words, “khandsari sugar” shall be omitted;

(xv) in S. No. 92, for the entry in column (3), the entry “Palmyra sugar, mishri, batasha, bura, sakar, khadi sakar, harda, sakariya, gatta, kuliya, elaichidana, lukumdana, chikkis like puffed rice chikki, peanut chikki, sesame chikki, til chikki, til patti, til revdi, sugar makhana, groundnut sweets, gajak, khaja, khajuli, anarsa” shall be substituted;

(xvi) in S. No. 100 A, in column (3), after the words “Roasted Gram”, the words “,idli/dosa batter, chutney powder” shall be inserted;

(xvii) for S. No. 111 and the entries relating thereto, the following shall be substituted, namely:-

| “111 | 2503 | Hop Sulphur of all kinds, other than sublimed sulphur, precipitated sulphur and colloidal sulphur ” ;cones, ground, powdered or in the form of pellets; lupulin” ; |

xviii) in S. No. 135, in column (3), after the words, figures and letters “natural boric acid containing not more than 85% of H3BO3” the brackets and words “(calculated on dry weight)” shall be inserted;

(ix) after S. No. 156 and the entries relating thereto, the following serial number and the entries shall be inserted, namely:-

| “156A | 2621 | Fly Ash ” ; |

(xx) for S. No. 189 and the entries relating thereto, the following shall be substituted, namely:-

| “189 | 4011 30 00 | New pneumatic tyres, of rubber of a kind used on aircraft”; |

\(xxi) after S. No. 197 and the entries relating thereto, the following serial number and the entries shall be inserted, namely:-