GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 45/2017-Central Tax (Rate)

New Delhi, the 14th November, 2017

G.S.R….(E).- In exercise of the powers conferred by sub-section (1) of section 11 of the Central Goods and Services Tax Act, 2017 (12 of 2017) ( hereafter in this notification referred to as “the said Act”), the Central Government, on being satisfied that it is necessary in the public interest so to do , on the recommendations of the Council, hereby exempts the goods specified in column (3) of the Table below, from the so much of the central tax leviable thereon under section 9 of the said Act, as in in excess of the amount calculated at the rate of 2.5 per cent., when supplied to the institutions specified in the corresponding entry in column (2) of the Table, subject to the conditions specified in the corresponding entry in column (4) of the said Table-

Table

| S. No. |

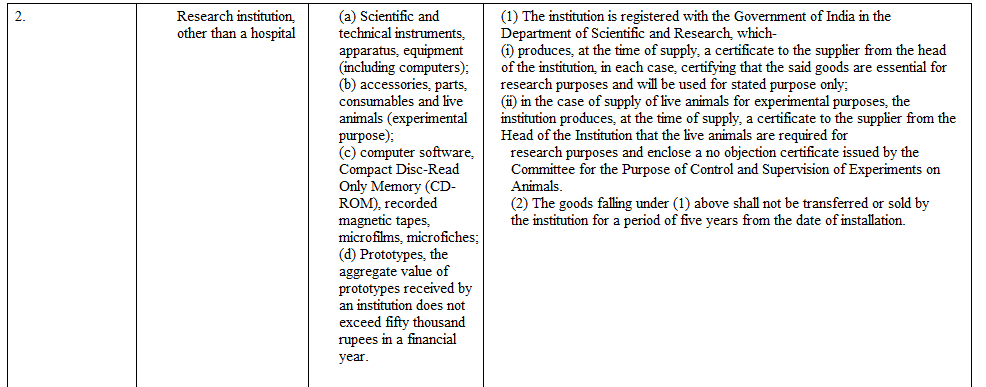

Name of the Institutions | Description of the goods | Conditions |

| (1) | (2) | (3) | (4) |

| 1. | Public funded research

institution other than a hospital or a University or an Indian Institute of Technology or Indian Institute of Science, Institute Technology/ Regional Engineering College |

(a) Scientific and technical

instruments, apparatus, equipment (including computers); (b) accessories, parts, (c) computer software, Compact Disc-Read Only Memory (CD-ROM), recorded magnetic tapes, by an institution does not |

(i) The goods are supplied to or for –

(a) a public funded research institution under the administrative control of the Department of Space or Development Organisation of the Government of India and such institution produces a certificate to that effect from an officer not below the rank of the Deputy Secretary to the Government of India or the Deputy Secretary to the State Government or the Deputy Secretary in the Union Territory in the concerned department to the supplier at the time of supply of the specified goods; or (b) an institution registered with the Government of India in the Department of Scientific and Research and such institution produces a certificate from an officer not below the rank of the Deputy Secretary to the Government of India or the Deputy Secretary to the State Government or the Deputy Secretary in the Union territory in concerned department to the supplier at the time of supply of the specified goods; (ii) The institution produces, at the time of supply, a certificate to the supplier from the Head of the Institution, in each case, certifying that the said goods are required for research purposes only; (iii) In the case of supply of live animals for experimental purposes, the institution produces, at the time of supply, a certificate to the supplier from the Head of the Institution that the live animals are required for research purposes and enclose a no objection certificate issued by the Committee for the Purpose of Control and Supervision of Experiments on Animals. |

Explanation. – For the purposes of this notification, the expression, –

(a) “Public funded research institution” means a research institution in the case of which not less than fifty per-cent. of the recurring expenditure is met by the Central Government or the Government of any State or the administration of any Union territory;

(b) “University” means a University established or incorporated by or under a Central, State or Provincial Act and includes –

(i) an institution declared under section 3 of the University Grants Commission Act, 1956 (3 of 1956) to be a deemed University for the purposes of this Act;

(ii) an institution declared by Parliament by law to be an institution of national importance;

(iii) a college maintained by, or affiliated to, a University;

(c) “Head” means –

(i) in relation to an institution, the Director thereof (by whatever name called);

(ii) in relation to a University, the Registrar thereof (by whatever name called);

(iii) in relation to a college, the Principal thereof (by whatever name called);

(d) “hospital” includes any Institution, Centre, Trust, Society, Association, Laboratory, Clinic or Maternity Home which renders medical, surgical or diagnostic treatment.

2. This notification shall come into force with effect from the 15th day of November, 2017.