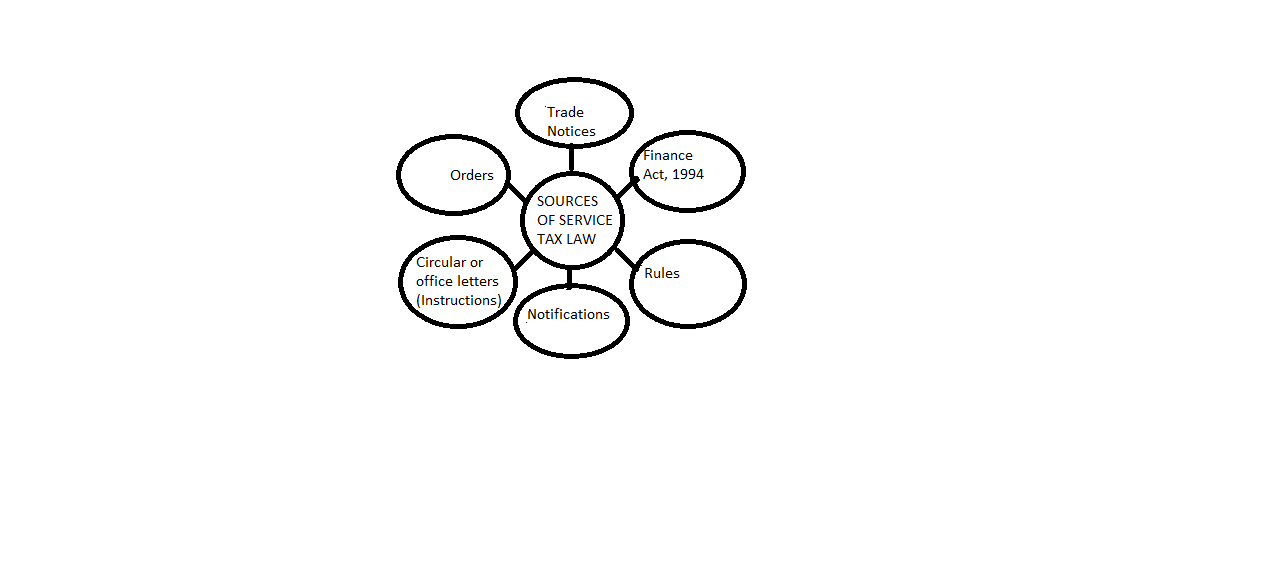

Sources of service tax law :

Service tax was introduced in the year 1994 but till date, there is no independent statute for levying service tax. However, following sources provide statutory provisions relating to service tax and can be broadly grouped under the following categories:

(1) Finance Act, 1994: The statutory provisions relating to levy of service tax on services were first promulgated through Chapter V of the Finance Act, 1994. Since then, Chapter V of the Finance Act, 1994 is working as the Act for the service tax levy. Later, in the year 2003, the Finance Act, 2003 inserted Chapter VA to deal with advance rulings.

In the year 2004, the provisions relating to levy of ‘education cess‘ on the amount of service tax were made applicable through Chapter VI of the Finance (No.2) Act, 2004 and in the year 2007, the provisions relating to levy of ‘Secondary and Higher education cess‘ on the amount of service tax were made applicable through Chapter VI of the Finance Act, 2007. However, with effect from 01.06.2015, Education Cess and Secondary and Higher Education Cess leviable on taxable services have ceased to be in force.

Swach Bharat Cess: The Finance Act, 2015 has empowered the Central Government to impose a Swachh Bharat Cess on all or any of the taxable services at a rate of 2% on the value of such taxable services. This cess shall be levied from such date as may be notified by the Central Government. The details of coverage of this Cess would be notified in due course. However, no notification has been issued in this regard, as ye t.

(2) Rules on service tax: Section 94 of Chapter V and section 96 -I of Chapter VA of the Finance Act, 1994 grants power to the Central Government for making rules for effective carrying out the provisions of these Chapters. Using these powers, the Central Government has issued the Services Tax Rules 1994, Service Tax (Advance Rulings) Rules, 2003, Service Tax (Registration of Special Category of Persons) Rules, 2005, Service Tax (Determination of Value) Rules, 2006, Point of Taxation Rules, 2011, Place of Provision of Service Rules, 2012 etc.

Rules should be read with the statutory provisions contained in the Act. Rules are made for carrying out the provisions of the Act and the rules cannot override the provisions contained in the Act i.e. in short, the rules can never override the Act and cannot be in conflict with the same.

(3) Notifications on service tax: Sections 93 and 94 of Chapter V, and section 96-I of Chapter VA of the Finance Act, 1994 empower the Central Government to issue notifications to exempt any service from service tax and to make rules to implement service tax provisions. Accordingly, notifications on service tax have been issued by the Central Government from time to time. These notifications usually declare date of enforceability of service tax provisions, provide rules relating to service tax, make amendments therein, provide or withdraw exemptions from service tax or deal with any other matter which the Central Government may think would facilitate the governance of service tax matters.

(4) Circulars or Office Letters (Instructions) on service tax: The Central Board of Excise and Customs (CBEC) issues departmental circulars or instruction letters from time to time to explain the scope of taxable services and the scheme of service tax administration etc. These circulars/instructions have to be read with the statutory provisions and notifications on service tax.

The circulars clarify the provisions of the Act and thus, bring out the real intention of the legislature. However, the provisions of any Act of the Parliament cannot be altered or contradicted or changed by the Departmental circulars.

(5) Orders on service tax: Orders on service tax may be issued either by the CBEC or by the Central Government. Rule 3 of the Service Tax Rules, 1994, empowers the CBEC to appoint such Central Excise Officers as it thinks fit for exercising the powers under Chapter V of the Finance Act, 1994. Accordingly, orders have been issued by the CBEC, from time to time, to define jurisdiction of Central Excise Officers for the purposes of service tax.

(6) Trade Notices on service tax: Trade Notices are issued by the Central Excise/Service Tax Commissionerates. These Commissionerates receive various instructions from the Ministry of Finance or Central Board of Excise & Customs for effective implementation and administration of the various provisions of service tax law. The same are circulated among the field officers and the instructions which pertain to trade are communicated to them in the form of trade notices. Trade Associations are supplied with the copies of these trade notices. Individual assesses may also apply for copies of trade notices. The trade notice disseminate the contents of the notifications and circulars/letters/orders, define their jurisdiction; identify the banks in which service tax can be deposited; give clarifications regarding service tax matters, etc.

The various components making service tax law have been represented in the following diagram: