Special cases

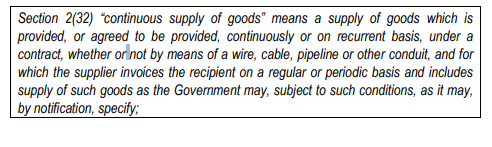

a. Continuous supply of goods: In case of a continuous supply of goods as defined in Section 2(32), the tax invoice is required to be issued:

— when the statement or a running-claim is issued; or

— when payment is received.

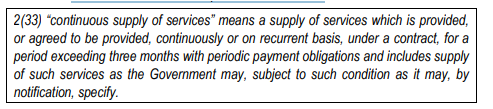

b. Continuous supply of services: In case of a continuous supply of services as defined in Section 2(33) of the Act, a tax invoice is required to be issued as follows:

(i) When payment date is ascertainable as per the contract:

o On or before the due date for payment.

(ii) When payment date is not ascertainable from the contract:

o On or before the time when the supplier of services receives the payment.

(iii) When payment is linked to completion of an event:

o On or before the date of completion of the event.

c. Goods sent on approval: Where goods are sent on approval basis, an invoice would not be required at the time of removal of goods, and shall be issued only at the time of receipt of approval from the recipient. However, if the goods so dispatched have neither been accepted nor been returned within 6 months from the date of their removal, the tax invoice is required to be issued on the date immediately succeeding the date on which the 6-month period expires.

d. Goods sent on SKD / CKD conditions: Where the goods are being transported in a semi knocked down (SKD) or completely knocked down (CKD) conditions, the supplier must first issue the complete invoice before the first consignment is moved, and must also issue a copy along with every consignment. All other consignments must be accompanied by a delivery challan in terms of Rule 55 of the CGST Rules, 2017 along with a certified copy of the invoice. It is imperative to note that the original invoice must accompany the last consignment.

e. Cessation of service: On cessation of a contract for supply of services, a tax invoice is required to be issued to the extent of supply effected up to the point of cessation, and due tax shall be remitted thereon.

f. Bill-to-ship-to transactions: Where the place of supply is deemed to be the principal place of business of the person on whose direction the goods are dispatched to another person (as specified in Section 10(1)(b) of the IGST Act, 2017), the transaction would have 2 supplies. While one supply would be from the supplier to the person to whom the invoice is addressed, another supply would be deemed to be effected by the said addressee to the person who receives the goods. In such a case, the person may consider the date of making available of the goods to the ultimate recipient, as the date on which the tax invoice is liable to be issued by him.

g. Goods sent to job worker for the purpose of job work: Where inputs or capital goods have been sent to the job worker for the purposes of job work, and have neither been returned nor been directly dispatched for supply from the place of the job worker within the timelines specified in Section 19, it shall be deemed that such goods have been supplied by the Principal to the job worker as on the date of dispatch of such goods to the job worker (or the date of receipt of goods by the job worker where the goods were sent to the job worker’s premises without being first received at the place of business of the Principal).