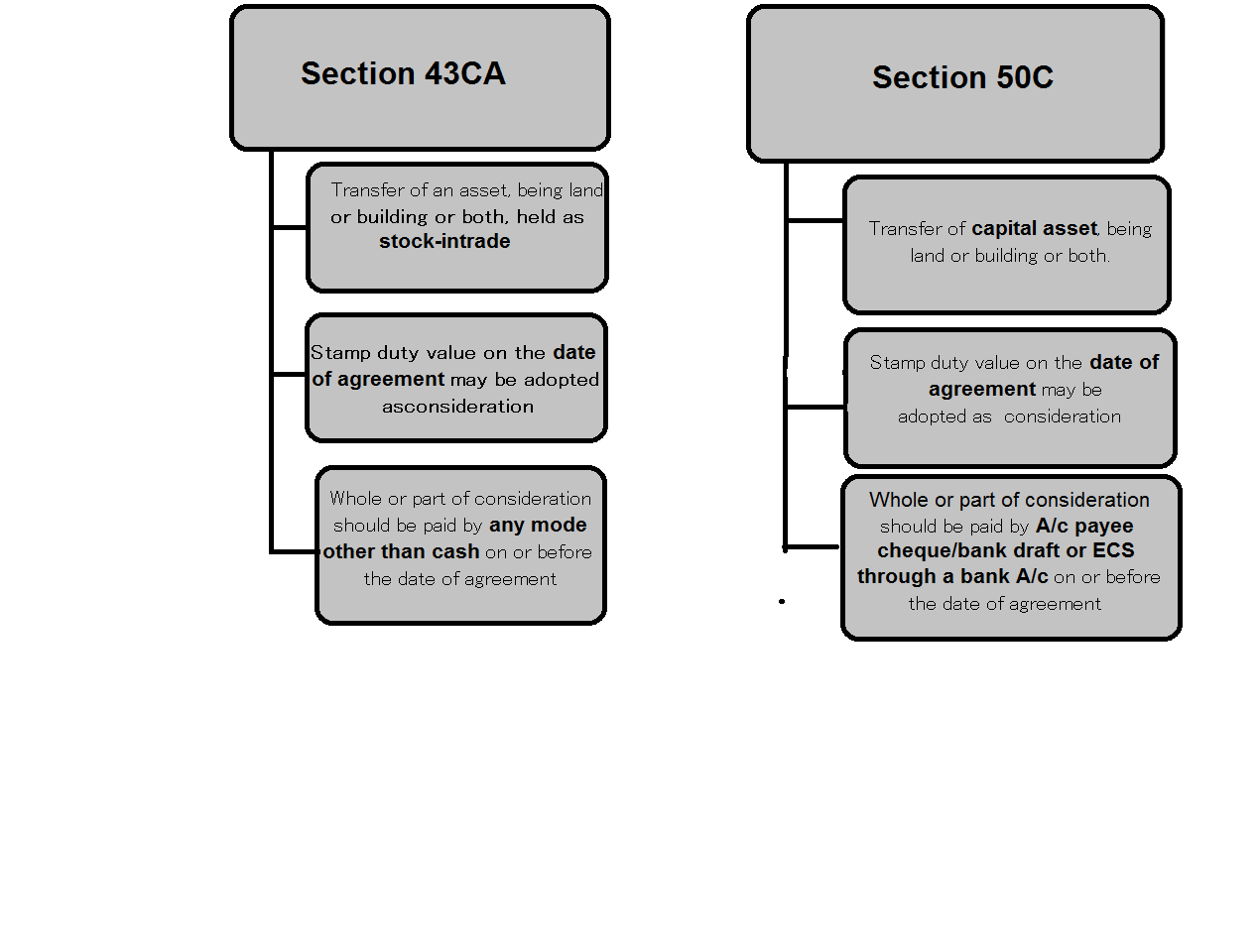

Stamp duty value on the date of agreement may be adopted as full value of consideration of immovable property, being land or building or both, if whole or part of the consideration has been paid by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account, on or before the date of the agreement for the transfer of such immovable property [Section 50C]

Effective from: A.Y.2017-18

(i) Adoption of stamp duty value on the date of transfer as full value of consideration under section 50C

Under section 50C, in case of transfer of a capital asset being land or building or both, the value adopted or assessed by the stamp valuation authority for the purpose of payment of stamp duty shall be taken as the full value of consideration for the purposes of computation of capital gains, where the actual consideration is less than such value. The stamp duty value on the date of transfer has to be considered for the purpose of section 50C.

(ii) Adoption of stamp duty value on the date of agreement as full value of consideration under section 43CA

Section 43CA, which contains a similar provision in case of transfer of land or building or both constituting stock-in-trade of the assessee, permits adoption of stamp duty value on the date of agreement instead of the date of registration, if the date of agreement and the date of registration are not the same and amount of consideration or part thereof has been received by any mode other than cash on or before the date of agreement for transfer of the asset.

(iii) Absence of provision in section 50C to adopt stamp duty value on the date of agreement

The Income Tax Simplification Committee under the chairmanship of Justice Easwar has, in its first report, pointed out that section 50C does not provide any relief where the seller has entered into an agreement to sell the property much before the actual date of transfer of the immovable property and the sale consideration is fixed in such agreement in line with section 43CA.

(iv) Amendment in section 50C to ensure parity in tax treatment vis-a-vis section 43CA

Accordingly, in order to ensure parity in tax treatment, provisos have been inserted in section 50C(1) so as to provide that where the date of the agreement fixing the amount of consideration for the transfer of immovable property and the date of registration are not the same, the stamp duty value on the date of the agreement may be taken for the purposes of computing the full value of consideration.

(v) Condition for adoption of stamp duty value on the date of agreement

However, the stamp duty value on the date of agreement can be adopted only in a case where the amount of consideration, or a part thereof, has been paid by way of an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account, on or before the date of the agreement for the transfer of such immovable property.