Straight Line Method or Fixed Instalment Method or Original Cost Method :

Under this method, the same amount of depreciation is charged every year throughout the life of the asset. The amount and rate of depreciation is calculated as under.

Illustration :

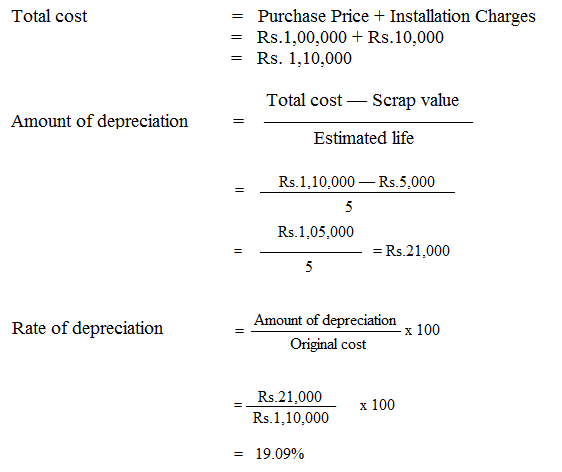

A company purchased Machinery for Rs.1,00,000. Its installation costs amounted to Rs.10,000. It’s estimated life is 5 years and the scrap value is Rs.5,000. Calculate the amount and rate of depreciation

Solution:

Note: Under straight line method, for each of the five years, the amount of depreciation to be charged will be Rs.21,000.