STRUCTURE AND INSTITUTIONAL DEVELOPMENT :

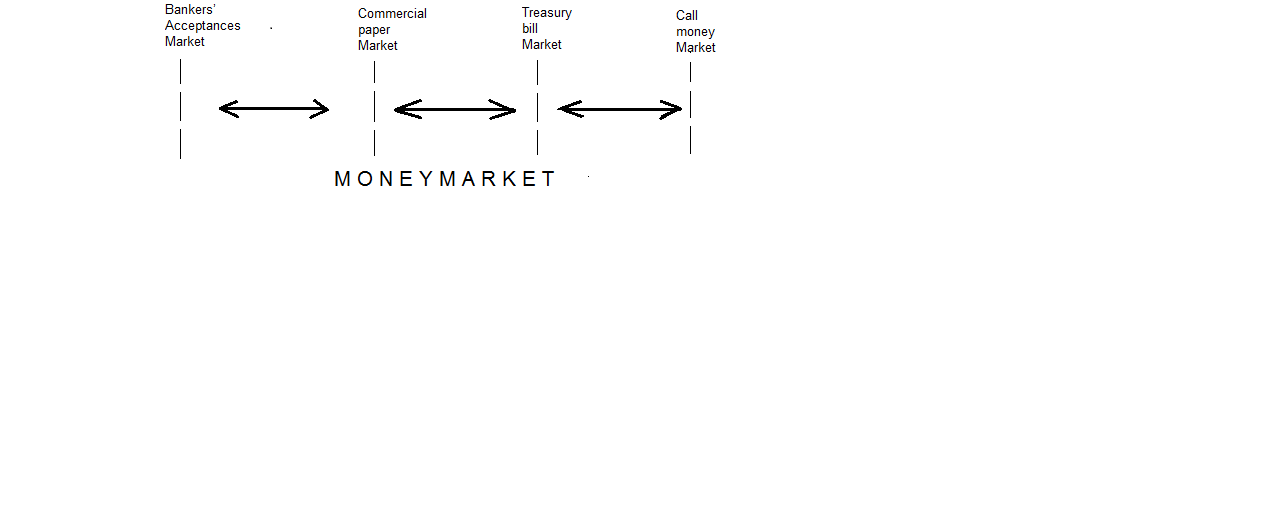

The following diagram depicts the important segments and inter-relation in the money market:

The Indian Money Market consists of two types of segments: an organized segment and an unorganized segment.

In the unorganized segment, interest rates are much higher than that in the organized segment.

The organized segment consists of the Reserve Bank of India, State Bank of India with its associate Banks, Public Sector Banks, Private Sector Commercial Banks including Foreign Banks, Regional Rural Banks, Non- Scheduled Commercial Banks, apart from Non-banking Financial Intermediaries such as LIC, GIC etc.

The unorganized segment essentially consists of indigenous bankers, money lenders and other non-bank financial intermediaries such as Chit Funds. For these institutions there is no clear cut demarcation between short-term and long-term and between a genuine trade bill and mere financial accommodation. The share of the unorganized sector in providing trade finance has greatly diminished after the Nationalization of Bank and expansion thereof into the length and breadth of the country.

![org]](http://www.taxdose.com/wp-content/uploads/2016/08/org.png)