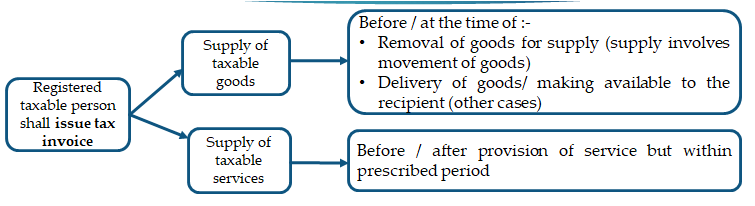

Tax Invoice – Sec 31

a)Revised invoices may be issued against the invoice already issued during the period starting from the effective date of registration till the date of issuance of certificate of registration within one month from date of issuance of certificate of registration.

b)No invoice required if value of goods or services or both < Rs. 200

c)Composition dealers and Person supplying exempted goods or services to issue a bill of supply instead of tax invoice

d)For receipts of advances on supply of goods / services: Receipt voucher/ other prescribed document

e)In case of RCM or if goods / services are received from an unregistered person, the registered taxable person shall issue an invoice

f)Refund of advance received in case of no supply of goods / services: Refund voucher against such advance

g)In case of RCM or if goods / services are received from an unregistered person: Registered person to issue payment voucher at the time of making payment

h)In case of continuous supply of goods where successive statements of accounts/ payments are involved, invoice shall be issued before or at the time of each such statements/ payment.

i)In case of continuous supply of services

ØDue date ascertainable – invoice to be issued before / after payment is liable to be made by recipient but within prescribed period (whether or not payment received)

ØDue date not ascertainable – invoice to be issued before / after each such time supplier receives payment but within prescribed period

ØPayment linked to completion of an event – invoice to be issued before / after time of completion of that event but within prescribed period