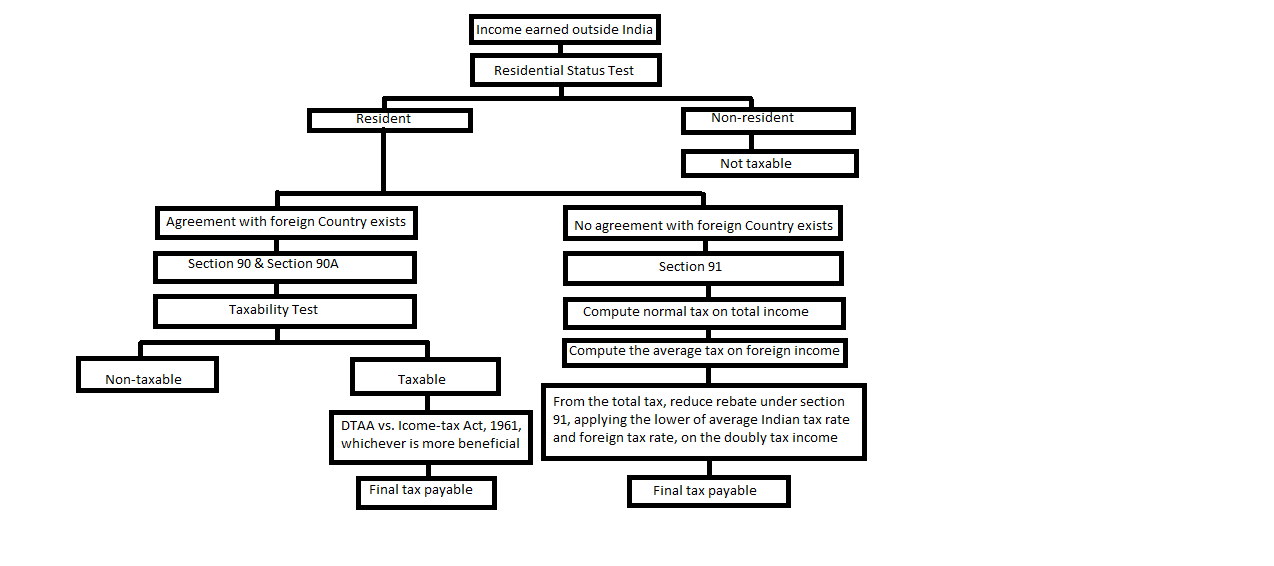

Taxing Foreign Income :

| Meaning of important terms:

(i) “Indian rate of tax” means the rate determined by dividing the amount of Indian incometax after deduction of any relief due under the provisions of the Act but before deduction of any double taxation relief due to the assessee. (ii) “Rate of tax of the said country” means income-tax and super-tax actually paid in that country in accordance with the corresponding laws in force in the said country after deduction of all relief due, but before deduction on account of double taxation relief due in the said country, divided by the whole amount of income assessed in the said country. (iii) The expression “income-tax” in relation to any country includes any excess profits tax or business profits tax charged on the profits by the Government of any part of that country or a local authority in that country. |