THE TRANSITIONAL PROVISIONS in the model GST law –––

1. Appointment of GST officers / Competent Authorities [Section 141]:

- All Central/State Government officials of Central/State laws (being subsumed in GST) and continuing in office on the appointed day shall be deemed to have been appointed as GST officers / Competent Authorities.

- The Central/State Government shall have the power to issue orders or make rules for smooth transition to GST.

2. Migration of existing taxpayers to GST [Section 142]:

- On the appointed day provisional certificate of registration would be issued to every person registered under any law being subsumed;

- The provisional certificate shall be valid for 6 months (or time as extended) and within the said period the provisional certificate holder shall be required to furnish information as may be prescribed.

- Once the information has been furnished the provisional certificate holder shall be issued a final certificate of registration.

- Failure to furnish the information may lead to cancellation of the provisional certificate.

- If a person is not liable for registration under GST then he may apply for cancellation of the provisional certificate issued to him.

3. CENVAT credit or VAT ITC C/F in a return to be allowed as ITC under GST [Section 143]:

- Any CENVAT credit or VAT ITC carried forward in the last return prior to GST shall be allowed as ITC in GST, subject to the condition that it was admissible as ITC in the earlier law and is also admissible as ITC in GST.

- If any proceeding has been instituted against the taxable person under the earlier law, either before or after the appointed day, with regard to the admissibility of ITC then it shall be recovered as an arrear of tax under GST.

4. Situations where un-availed CENVAT credit/ITC on capital goods, not carried forward in a return, to be allowed as ITC under GST [Section 144]:

- Un-availed CENVAT credit/ITC on capital goods which has not been carried forward in a return under the earlier law will be admissible as ITC under GST in the manner to be prescribed.

- “Un-availed CENVAT credit”/ “un-availed ITC” means the differential amount of the aggregate of eligible CENVAT credit/ITC in respect of the said capital goods under the earlier law and CENVAT credit/ITC already availed in respect of such capital goods;

- For CENVAT credit the capital goods means the goods as defined under clause (a) of rule 2 of CENVAT Credit Rules, 2004.

- If any proceeding has been instituted against the taxable person under the earlier law, either before or after the appointed day, with regard to the admissibility of ITC then it shall be recovered as an arrear of tax under GST.

5. Situations where credit of eligible duties and taxes in respect of inputs held in stock to be allowed as ITC under GST [Section 145]:

► A registered taxable person who was not liable to be registered under the earlier law or was a manufacturer of goods (exempted under the earlier law, but taxable under GST) shall be entitled to take credit of eligible duties and taxes/value added tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the appointed day subject to the following conditions:

- such inputs and/or goods are used or intended to be used for making taxable supplies in GST;

- he was eligible for CENVAT credit/ITC on receipt of such inputs and/or goods if he had been liable for registration under the earlier

- law or if such goods had been taxable under the earlier law;

- he is eligible for ITC in GST;

- he is in possession of invoice and/or other prescribed documents evidencing payment of duty / tax under the earlier law in respect of such inputs held in stock, etc; and

- such invoices and /or other prescribed documents were issued not earlier than 12 months prior to the appointed day.

► The amount of credit shall be calculated in accordance with the generally accepted accounting principles (i.e. GAAP) and in the manner as may be prescribed.

► If any proceeding has been instituted against the taxable person under the earlier law, either before or after the appointed day, with regard to the admissibility of ITC then it shall be recovered as an arrear of tax under GST

► Under the CGST law “Eligible duties and taxes” in respect of units held in stock, etc on the appointed day, means –

✓ Excise duty specified in the First & Second Schedule to The Central Excise Tariff Act, 1985;

✓ Additional duty of excise leviable under section 3 of the:

♢ Additional Duties of Excise (Textile and Textile Articles) Act, 1978, and

♢ Additional Duties of Excise (Goods of Special Importance) Act, 1957;

✓ the National Calamity Contingent Duty leviable under section 136 of the Finance Act, 2001;

✓ the additional duty leviable under:

♢ section 3(1) of the Customs Tariff Act, 1975;

♢ section 3(5) of the Customs Tariff Act, 1975;

✓ the service tax leviable under section 66B of the Finance Act, 1994;

6. Credit of ‘eligible duties and taxes’ / ITC on inputs held in stock to be allowed to a taxable person switching over from composition scheme [section 146]:

► A “composition taxpayer” under earlier law shall be entitled to take ITC on stock of inputs and on semi finished or finished goods held in stock on the appointed date subject to the following conditions:

✓such inputs and / or goods are used or intended to be used for making taxable supply;

✓ he was eligible for CENVAT credit/ITC on receipt of such inputs and/or goods if he had been liable for registration under the earlier law or if such goods had been taxable under the earlier law;

✓ the said person is not under composition scheme in GST (Section 8);

✓ he is eligible for ITC in GST;

✓ he is in possession of invoice and/or other prescribed documents evidencing payment of duty / tax under the earlier law in respect of such stock, semi-finished or finished goods; and

✓ such invoices and /or other prescribed documents were issued not earlier than twelve months immediately preceding the appointed day.

► The amount of credit shall be calculated in accordance with generally accepted accounting principles in such manner as may be prescribed.

► The amount taken as credit as above shall be recovered as an arrear of tax under this Act from the taxable person if the said amount is found to be recoverable as a result of any proceeding instituted, whether before or after the appointed day, against such person under the earlier law.

7. Amount payable in the event of a taxable person switching over to composition scheme [Section 147]:

► If a taxable person, who has carried forward eligible credit in the last return furnished under the earlier law to GST, switches over to composition scheme in GST, he shall pay an amount equivalent to the credit of input tax in respect of inputs held in stock, etc by debiting his electronic credit ledger/ cash ledger.

► The balance of ITC, if any, lying in his electronic credit ledger after making good the above payment shall lapse.

8. Exempted goods returned to the place of business on or after the appointed day [Section 148]:

► If goods exempt from duty/tax under the earlier laws (dispatched within 6 months prior to the appointed day) are returned to any place of business within 6 months from the appointed day, no taxshall be payable while

returning them on the condition that the goods are identifiable.

► If the said goods are taxable in GST and are returned after 6 months from the appointed day then tax shall be payable by the person returning those goods.

9. Duty/tax paid goods returned to the place of business on or after the appointed day [Section 149]:

► If duty/tax paid goods under earlier law (dispatched within 6 months prior to the appointed day) are returned to any place of business within 6 months from the appointed day, no tax shall be payable while returning them on the condition that the goods are identifiable.

► If the goods are taxable in GST and are returned after 6 months from the appointed day then tax shall be payable by the person returning those goods.

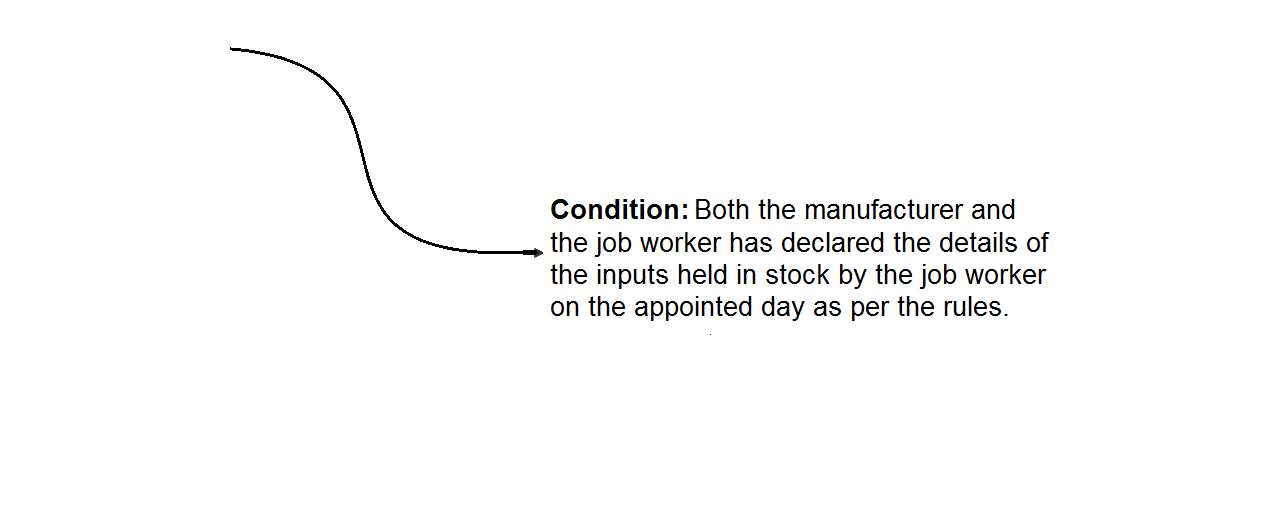

10. Inputs removed for JOB WORK and returned on or after the appointed day [Section 150]:

► Where inputs received in a factory had been removed as such or after being partially processed to a job worker for further processing, testing etc., before the appointed day, then no tax shall be payableif it is returned to the factory after completion of job work within 6 months (or within the extended period of further 2 months).

► If such inputs are returned after the stipulated period and are taxable in GST then, tax shall be payable by the job worker.

► Further, if such goods are taxable in GST and are not returned within the stipulated period then tax shall be payable by the manufacturer.

11. Semi-finished goods removed for job work and returned on or after the appointed day [Section 151]:

► Where semi-finished goods that had been removed from factory for further manufacturing processes to any other premises before the appointed day are returned after completion of such process within 6 months (or within the extended period of further 2 months) from the appointed day then no tax shall be payable thereon.

► If such goods are returned after the stipulated period and are taxable in GST then, tax shall be payable by the job worker;

► Further, if such goods are taxable in GST and are not returned within the stipulated period then tax shall be payable by the manufacturer;

► A manufacturer may in accordance with the provision of earlier law transfer the said goods to the premises of any registered taxable person for the purpose of –

12. Finished goods removed for carrying out certain processes and returned on or after the appointed day [section 152]:

► Where any *goods (*excisable goods manufactured in a factory for CGST law) removed/dispatched without payment of duty/tax to any other premises for testing or processing before the appointed day are returned to the factory/place of business within 6 months (or extended period of further two months), from the appointed day, then notax shall be payable thereon.

►Tax shall be payable by the person returning those goods if such goods are returned after the stipulated period and are taxable in GST.

► A manufacturer (or person dispatching the goods in SGST law) may in accordance with the provision of earlier law transfer the said goods to the premises of any registered taxable person for the purpose of –

- ✓making supply in India on payment of tax, or exports without payment of tax

- ✓exports without payment of tax

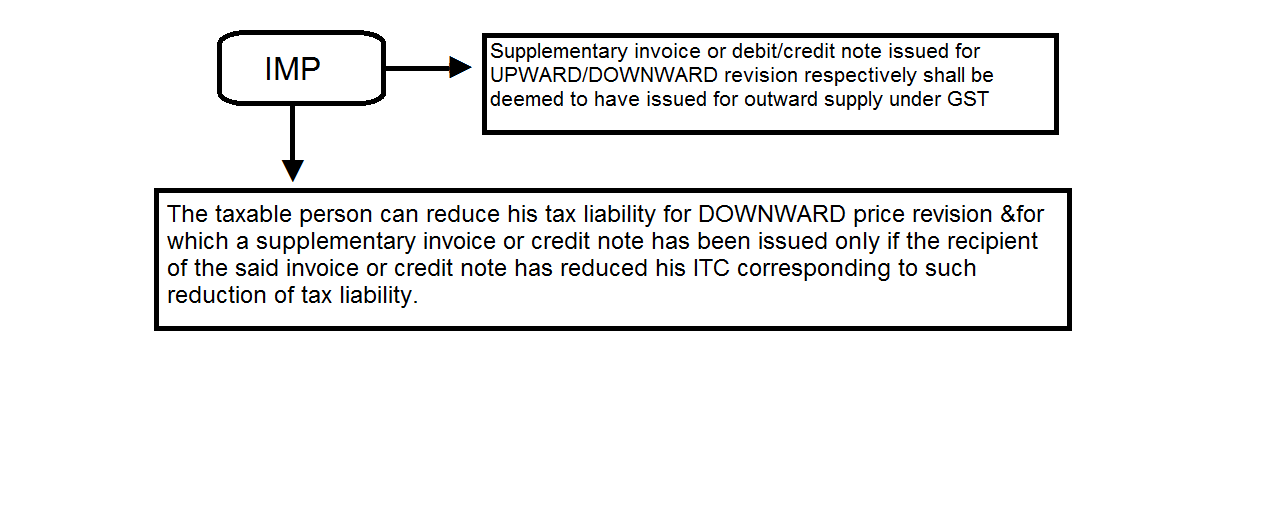

13. Issue of supplementary invoices, debit or credit notes where price is revised in pursuance of a contract [Section 153]:

►As a result of any earlier contract entered into prior to the appointed day, the price of any goods and/or service is revised upward or downward, on or after the appointed day, the taxable person who removed/sold or provided such goods and/or service may issue to the recipient a supplementary invoice or debit/credit note as applicable within 30 days of such price revision.

14. Pending refund claims to be disposed of under earlier law[154]:

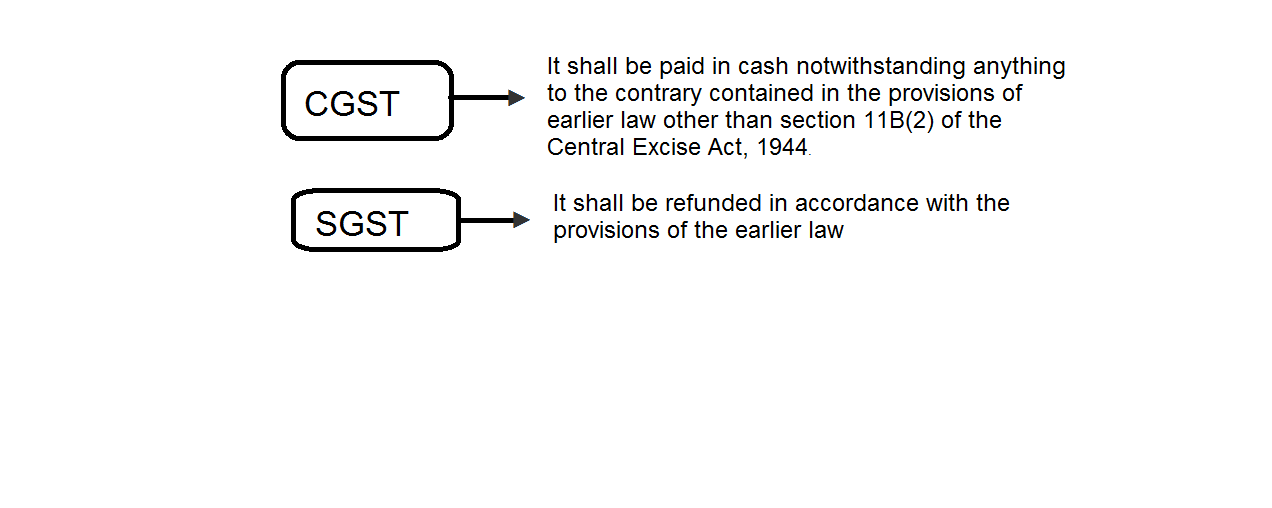

► Every claim of refund of duty/tax and interest, if any, filed before the appointed day shall be disposed of as per the provisions of the earlier law. If any amount accrues for refund –

► Where any claim for refund is fully or partially rejected, the amount so rejected shall lapse.

15. Claim of CENVAT credit / ITC to be disposed of under the earlier law [Section 155]:

► The appeal, revision, review and reference relating to claim or recovery of CENVAT credit / ITC, initiated before the appointed day, shall be disposed of as per the provisions of the earlier law.

16. Finalization of proceedings relating to output duty liability [Section 156]:

► The appeal, revision, review and reference relating to any output duty/output tax, liability, initiated before the appointed day, shall be disposed of as per the provisions of the earlier law.

17. Treatment of the amount recovered or refunded in pursuance ofassessment or adjudication proceedings [Section 157]:

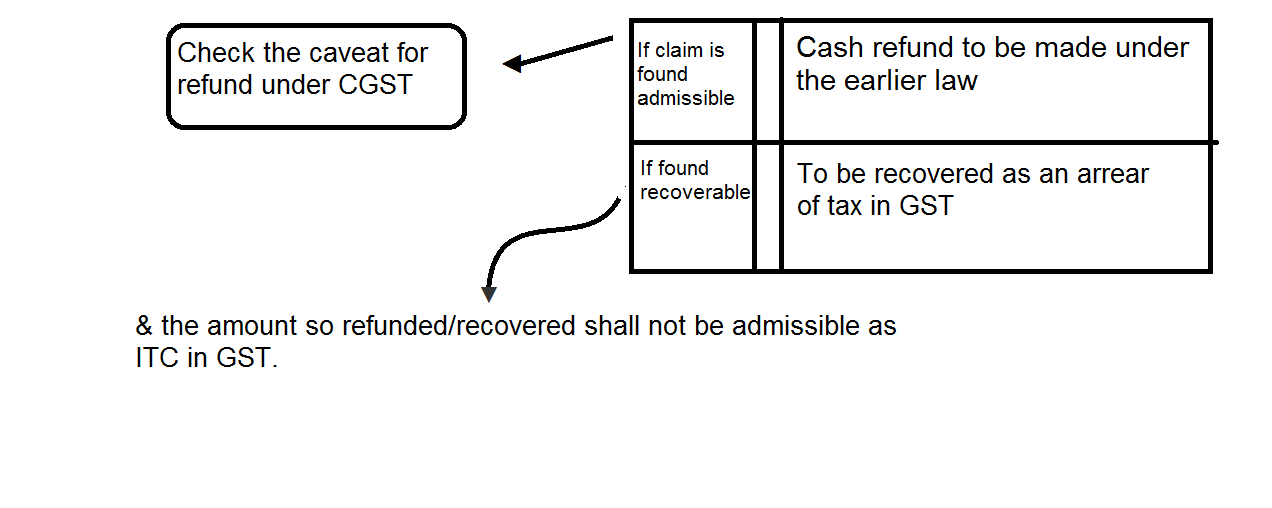

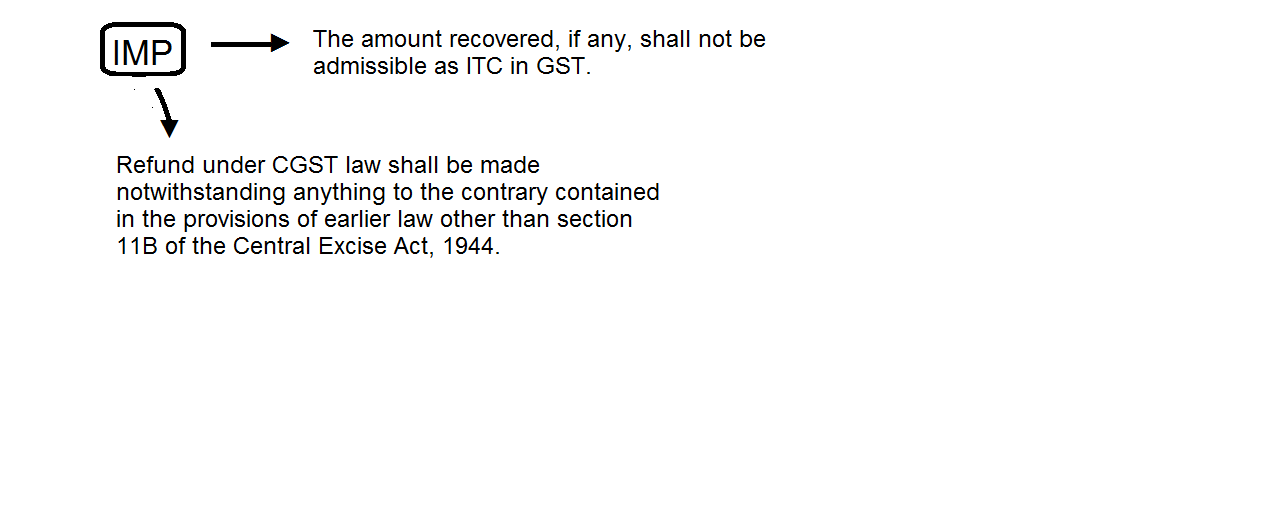

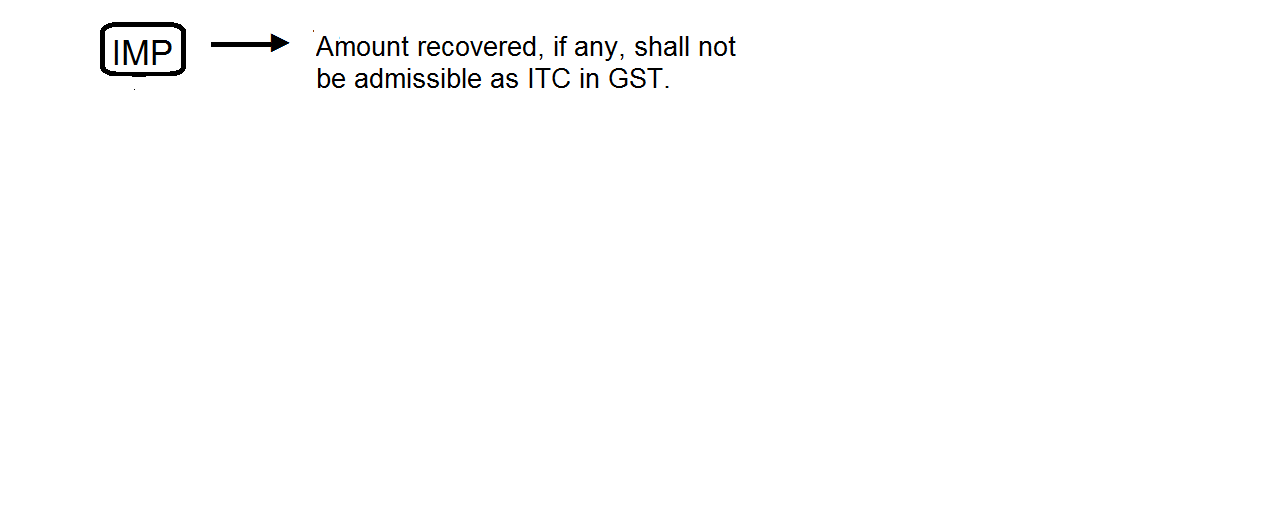

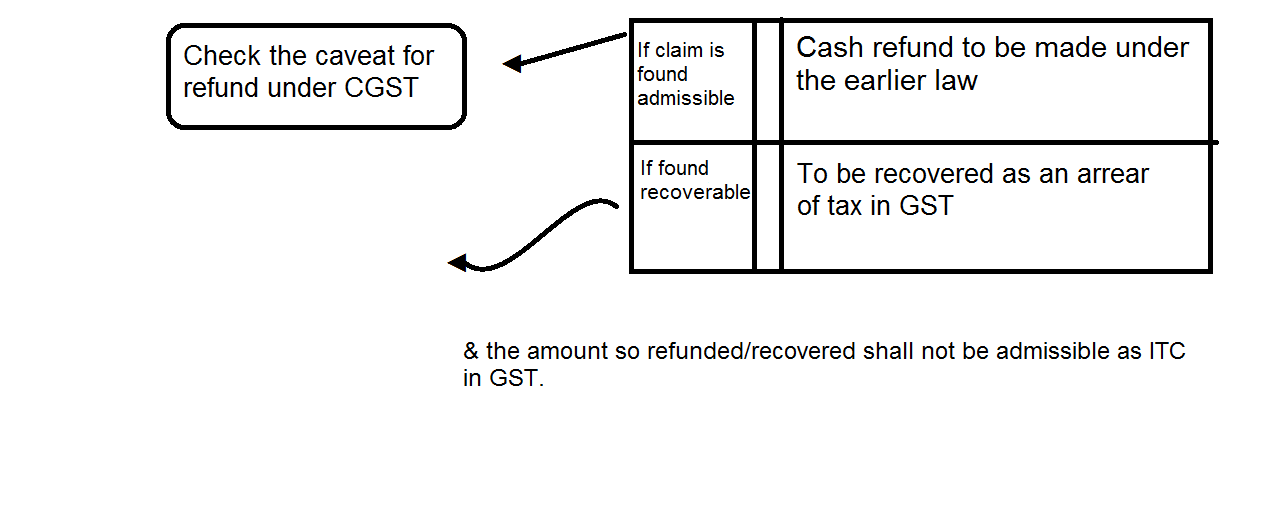

► Any amount of tax, interest, fine or penalty found recoverable on any assessment or adjudication under the earlier law, instituted before or after the appointed day, would be recovered as an arrear of tax in GST. And, in case it is found admissible to the claimant it shall refunded (CGST – cash refund & SGST – as per the provisions of the earlier law).

18. Treatment of the amount recovered or refunded pursuant to revision of returns [Section 158]:If any amount

► becomes recoverable due to the filing of a revised return relating to the earlier law then such an amount shall be recovered as an arrear of tax under this Act. And, in case it is found refundable to the taxable person then it shall refunded (CGST – cash refund & SGST – as per the provisions of the earlier law).

19. Treatment of long term construction / works contracts [Section 159]:

► In pursuance to a contract entered into before the appointed day, if any goods and/or services are supplied on or after the appointed day then tax shall be payable on it in GST.

20. Progressive or periodic supply of goods or services [Section 160]:

► Where consideration for supply of goods and/or services has been received prior to the appointed day & duty/tax has already been paid as per the earlier law, then no tax shall be payable on supply of it made on or after the appointed day.

21. Treatment of retention payments [Section 161]:

► No tax shall be payable on part consideration received, on or after the appointed day, in respect supply of goods and /or services made before the appointed day where full duty/tax has already been paid under earlier law in respect of the said supply.

22. Credit distribution of service tax by ISD [Section 162, for CGST Act only]:

► The ITC on any services received prior to the appointed day by an Input Service Distributor (ISD) shall be eligible for distribution as credit in GST even if the invoice(s) relating to such services is received on or after the appointed day.

23. Tax paid on goods lying with agents to be allowed as credit [Section 162A, for SGST Act only]:

► An agent shall be entitled to take credit of the tax paid on goods belonging to the principal and lying at his premises on the appointed day subject to the following conditions:-

✓ the agent is a registered taxable person in GST;

✓ both the principal and the agent *declare the details of stock of goods lying with such agent on the date immediately preceding the appointed day;

✓ the invoices for such goods had been issued not earlier than 12 months prior to the appointed day; and

✓ the principal has either not availed of the ITC in respect of such goods or has reversed it.

24.Tax paid on capital goods lying with agents to be allowed as credit [Section162B, for SGST Act only]:

► An agent shall be entitled to take credit of the tax paid on capital goods belonging to the principal and lying at his premises on the appointed day subject to the following conditions:-

✓ the agent is a registered taxable person in GST; both the principal and the agent *declare the details of stock of capital goods lying with the agent on the date immediately preceding the appointed day;

✓ both the principal and the agent *declare the details of stock of capital goods lying with the agent on the date immediately preceding the appointed day;

✓ the invoices for such capital goods had been issued not earlier than 12 months prior to the appointed day; and

✓the principal has either not availed of the ITC in respect of such capital goods or has reversed it.

25. Treatment of branch transfers [Section 162C, for SGST Act only]:

► Any amount of ITC reversed (i.e. under VAT) prior to the appointed day for branch transfers shall not be admissible as credit as ITC in GST.

26. Goods sent on approval basis returned on or after the appointed day [Section 162D, for SGST Act only]:

► Where any goods sent on approval basis, not earlier than 6 months before the appointed day, are rejected or not approved by the buyer and are returned to the seller within 6 months from the appointed day (or within the extended period of further two months) then no tax shall be payable by him.

► If the goods are taxable in GST and are returned after the stipulated period stated above then tax shall be payable by the person returning those goods.

► Further, if such goods are not returned within the stipulated time as stated, then tax shall be payable in GST by the person who sent the goods on approval basis.

27. Deduction of tax at source (TDS) [section 162E, for SGST Act only]:

TDS shall not be deducted at the time of payment by the deductor in GST (relevant section is section 37) for any sale of goods made by a supplier before the appointed day & for which invoice has also been issued by him before the appointed day.