Time of Supply – Special Charges

Sometimes there may be charges imposed by the supplier on account of some deviation or special circumstance from the expected terms of contract on the part of the recipient. These special charges may be enabled by the contract though not necessarily attracted at the time of supply of the underlying goods or service (other than these special charges) or may be agreed later – when the special circumstance occurs. These special charges are listed as interest, late fee or penalty on account of delay in payment of consideration. In these cases, the time of supply is appointed to be the date of receipt by the supplier.

Please note that even though a debit note may be issued after reaching agreement with the recipient about the special charges imposed, the time of supply continues to remain ‘date of receipt’ of payment towards such special charges. This is a departure from the provisions on accrual principle in section 31. As this is a special provision, the same will prevail over all other general provisions.

It is important to understand that due to time of supply being prescribed, whether the imposition of these special charges is itself a supply or not? Please see the following comparative discussion

From the above discussion, several necessary conclusions need to be reached, namely:

(i) whether the three listed charges are exhaustive or only illustrative?

(ii) whether delay in payment is the only occasion when this provision is attracted or special charges imposed for any other default linked to the original supply will also attract this provision?

(iii) whether special charges imposed for any other default (not delay in payment) is liable to GST but not on receipt basis but accrual basis or are special charges for these cases not at all liable to GST?

It appears that the three listed cases are exhaustive not by the three cases listed but the circumstance for their imposition – delay in payment of consideration. So, any form of special charges imposed is liable to GST on receipt basis but only if it is due to delay in payment of consideration. Special charges imposed due to any other default by the recipient is then to be examined if it is linked to an ‘original supply’ or is it by itself a supply? If linked to an original supply, it is also liable to tax but not during enjoying flexibility to pay tax on receipt basis and tax being payable based on the date of debit note. If not linked to an original supply, GST would not be applicable if it does not satisfy the requirements of levy.

The issues raised in respect of special charges may be considered as matter of discussion and does not carry a procurement of an opinion on view. Readers are free to connect on these discussions and evaluate each such situation after giving it adequate conside ration or thought.

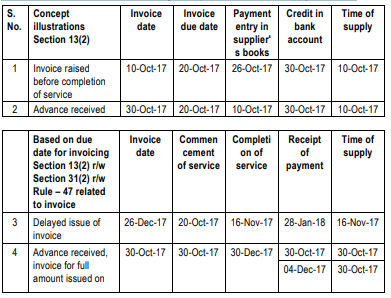

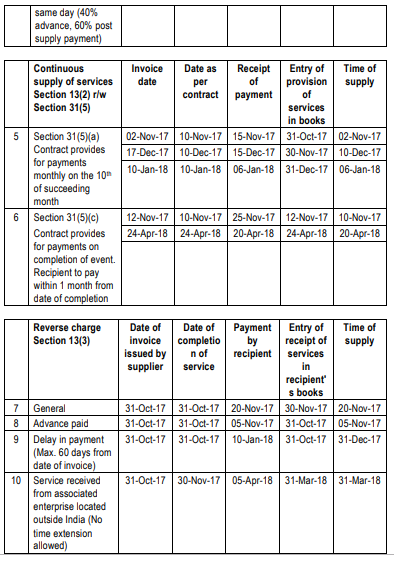

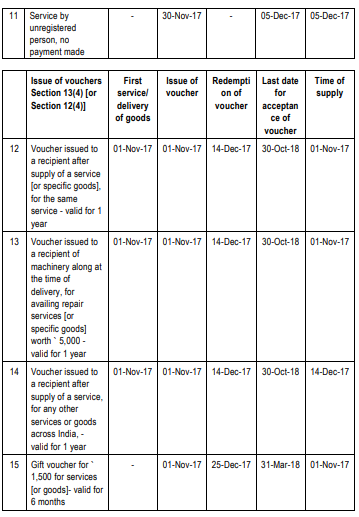

Some illustrations for better understanding of the provisions of time of supply of services