Time of Supply – Special Charges

Special charges imposed for delay in payment of consideration will enjoy the facility of time of supply being date of receipt of the charges imposed, that is, cash-basis of payment of GST.

The various issues involved in these special charges are discussed in detail under time of supply of services which may kindly be referred.

Illustration 13: Mr. X enters into a contract for supply of goods worth ` 5,00,000 with Mr. Y on 10th April 2018. Such goods are removed with an invoice dated 12th April 2018 on 13th April 2018 for delivery to Mr. Y. The terms of the contract demanded the payment against such supply to be made within 60 days beyond which a late payment charge of ` 10,000 will have to be paid by Mr. Y. Mr. Y makes the payment of Rs, 5,00,000 along with the late payment charges on 15th July 2018. What will be the time of supply in respect of the entire amount? Answer: In Section 12(2), the time of supply in respect of ` 5,00,000 will be the date of issuance of invoice or last date of issuance of invoice. Last date of issuance of invoice will be the date of removal where supply involves movement of goods.

Date of issuance of invoice: 12th April 2018

Last date of issuance of invoice: 13th April 2018 (date of removal)

The date of payment is immaterial as per Notification no. 66/2017-Central Tax dated 15th November 2017 as already discussed above. So, the time of supply will be 12th April, 2018 in respect of ` 5,00,000.

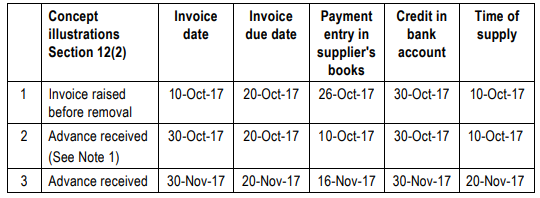

However, in respect of the time of supply for the amount of Rs, 10,000 paid as late payment charges, time of supply as per Section 12(6) has been stated to be the date on which the supplier receives the addition in value. Here, the additional amount of ` 10,000 is received on 15th July 2018. So, the time of supply for this amount will also arise on 15th July 2018.. Some illustrations for better understanding of the provisions of time of supply of goods

Notes:

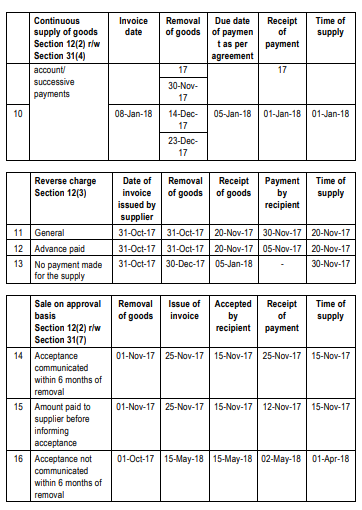

1. The Notification 40/2017 dated 13.10.2017 exempts a taxable person not registered under the composition scheme and having aggregate turnover less than ` 1.50 crores, for payment of tax on receipt of advance. This Notification will be effective from 13.10.2017 and as such a taxable person is liable to remit tax on any advances received prior to 13.10.2017

2. The Notification No. 66/2017 dated 15.11.2017 exempts all taxable persons from payment of tax on the advances received in relation to supply of goods. This Notification will be effective from 15.11.2017 and as such, the date of receipt of advance will not be relevant to determine the time of supply of goods thereafter.