Time of Supply – Vouchers

The Act introduces time of supply in respect of ‘vouchers’ as a separate category such that the provisions relating to time of supply of goods is made inapplicable when the supply is of such vouchers. Referring to Chapter III where in the context of supply, definition of goods has been discussed at length, we find specific inclusion of ‘actionable claims’.

In relation to actionable claims, Courts have held as follows:

(i) Actionable claims come within the definition of goods as generally understood.

(ii) VAT laws have deliberately excluded actionable claims from the definition of goods.

(iii) Actionable claims represent debt and accordingly carry a demand that can lawfully be made by one person against another.

(iv) Actionable claims represent property in non-physical (incorporeal) form. But in GST, unlike VAT laws, we find that by including actionable claims within the definition of goods, they are made liable to tax. In relation to actionable claims under GST, please note the following key aspects:

(i) Actionable claims are included specifically in the definition of goods, but this inclusion is by creating an exception from an exclusion. In other words, while excluding money and securities from the definition of goods, actionable claims have been singled out. This means such forms of actionable claims that represent property in the form of money or securities are also excluded from the definition of goods. Therefore, from a large population of actionable claims, tax is applicable only on the subset of actionable claims which do not represent property in the form of money or securities and all other forms of actionable claims representing any other property is includable in the definition of goods. A receipt for having made payment is not actionable claim because that receipt represents money and not the result of a transaction resulting in debt or demand. Similarly, promissory notes, IOU slips and all other derivatives of such instruments are also not actionable claims for the purposes of GST because of the exclusion of money from the definition.

(ii) Actionable claims which are included within the definition of goods do not become includable in the definition of services due to the accommodative and expansive language used to define services. For this reason, the property that actionable claims represent even if they are in non-physical form will continue to remain goods and not become services. Actionable claims so understood may or may not be itself in any physical form. In other words, actionable claim is not the piece of paper carrying the detailed description of the actionable claim in question but the real property, though in non-physical form, that is referred to in that piece of paper. In this digital age, piece of paper carrying the description of the actionable claim can even be present in electronic form and still retain the chart of actionable claim within the definition of goods. So, actionable claims can be in physical or electronic form as long as they represent real property.

About ‘actionable claims’ discussion in Chapter III would have highlighted that the incidence is limited to ‘lottery, betting and gambling’. Further, it is important to note that vouchers are not always referring only to actionable claims. Vouchers being treated as a separate category for the purposes of determining time of supply will need to be first identified in relation to supply before applying the relevant provision regarding its time of supply. Vouchers are defined in the Act as “an instrument where there is an obligation to accept it as consideration or part consideration for a supply of goods or services or both and where the goods or services or both to be supplied or the identities of their potential suppliers are either indicated on the instrument itself or in related documentation, including the terms and conditions of use of such instrument” and examples of voucher are coupon, token, ticket, license, permit, pass. Now, the time of supply in the case of vouchers is stated to be:

(i) the date of issue of voucher if the supply is identifiable at that point; or

(ii) in all other instances, the date of redemption of the voucher. Please refer to the section 13 regarding time of supply of services for detailed discussion on the overall aspect of vouchers.

Here, only the key aspects of the definition are discussed which may be referred back while examining the scope of section 13(4).

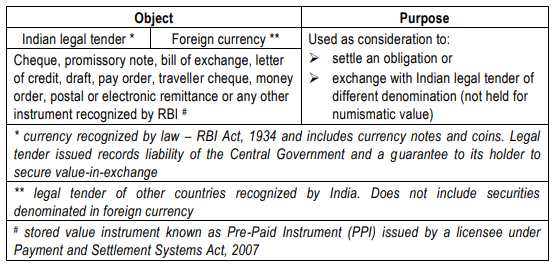

Money 2(75) may be represented as follows:

Money is therefore that which is ‘used as’ consideration between parties to a transaction.

Money does not represent a liability of the parties to the transaction. Money represents liability of the Central Government. A person who has money has an asset which represents a certain amount of value. There is requirement to specially prescribe ‘terms of use’ of money. It is known and is declared by the law that recognizes money to be legal tender. Money includes all ‘stored value’ instruments approved by RBI or PPIs. Value is stored in PPIs by transfer of Indian legal tender in cash or from bank account and any balance of stored value in PPIs can be withdrawn in ATM or retransferred back into bank account. PPIs are of three types – closed, semi-closed and open PPIs. There are two other kinds of hybrids where existing banking license-holders along with a technology partner can issue PPI-like stored-value products which operate as a specie of savings bank account of the PPI-holder or beneficiary.

PPIs can be physical bearer instruments as paper certificate or plastic card. PPIs can also be non-physical in the form of a digital wallet. Both represent stored value which is linked to a bank account of the beneficiary. PPIs are not to be misunderstood with Payments Bank. PPIs have more restrictions than a Payments Bank which is a scaled-down version of a regular savings bank account.

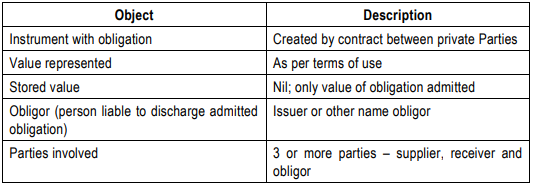

Voucher 2(119) may be represented as follows:

Voucher is therefore ‘instrument with obligation’ that is accepted as consideration. Voucher does not contain any ‘stored value’ but ‘value-to-use’. This ‘value-to-use’ is credited into a voucher by a contractual arrangement between the issuer-redeemer of the voucher. A customer who redeems the voucher is not a party to the arrangement for creation of the voucher. A voucher that is created changes hands through steps with a sliding -scale of discounts until it is redeemed at the face value. This ‘value-to-use’ at the time of its creating necessarily involves flow of payment from the issuer to the redeemer as such voucher represent cash/cash equivalent received in advance entailing an obligation. But this value -touse, cannot be converted to cash but only expended or redeemed as per terms of use of voucher. There is no regulation governing issue, transfer and redemption of vouchers except terms of a lawful contract. Vouchers are not PPIs and hence not governed by Payments and Settlement Systems Act, 2007. It is not uncommon for the available balance of ‘value -to-use’ to be credited into the digital wallet of a PPIs issued by the same issuer. But the difference is that the part of the wallet balance representing stored value can be withdrawn but not the partof the wallet balance representing value-to-use or voucher. Gift voucher issued by a merchant that is a bearer certificate with a unique identification number or code is not a voucher that agrees with this definition because this gift voucher is a close-ended PPI.

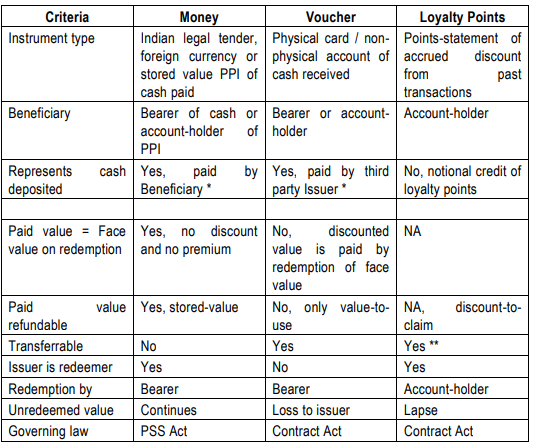

Another similar product is ‘loyalty points’ which also contains ‘value-to-use’ but the differences that in loyalty points, issuer-redeemer is the same person. Loyalty points issued represents liability of the issuer towards the beneficiary without any underlying flow of payment and is best described as ‘future discount’. That is, these points accrue in one transaction and based on some conversion ratio, that can be redeemed as a discount in a subsequent transaction. As the loyalty points are non-transferable where the issuer-redeemer is the same person, it is not an instrument with obligation. Discount allowed in the subsequent transaction is towards an cellation of points accrued from the earlier transaction. Similar to vouchers, loyalty points lso do not have any regulation governing its allotment and redemption except the terms of a lawful contract. Nowadays, it is seen that the liability that accumulated loyalty points represents, are being converted into voucher by transfer of liability by issuer to an intermediary at a discounted value. From here on wards, due to intermediary’s involvement, an instrument comes into existence with an obligation which is voucher, Yet another product coupon or token in the form of a ‘code’, where a customer becomes entitled to discount at the very first purchase by citing this ‘code’. It is interesting to note that entitlement to this code though not flowing from a transaction in the past, it is an entitlement by accepting to enter into a transaction in the future. This acceptance is recorded by registering on a website, downloading an app or any other positive act on the part of the customer. Such codes also do not satisfy the requirements of a voucher for the same reasons as applicable to loyalty points.

Among all these lies another transaction that may appear to overlap with definition of voucher, due to the words of common understanding being used interchangeably with words having specific statutory meaning and that is ‘Pass’. Pass is one which could be an entry pass or customer’s pass or a free ticket. For example, a ticket to a cricket match is available for `1,000/- but a company buys these tickets and distributes it to key customers as ‘free pass’. It allows the customer to enjoy the cricket match without paying anything for the same. But the company has already paid the ticket price to the organizers of the cricket match. Another example could be free pass to view screening of a film and so on. There is a normal taxable supply between the supplier of goods or services and the person who pays and buys the ‘pass’. There is another supply to be examined, between the person who pays and the person who actually enjoys the goods or services. Whatever may the conclusions reached regarding the two transaction here, there is no voucher that comes into existence even if such entry tickets are even designated as ‘free pass – not for sale’ and so on. However, if such ‘passes’ are printed and distributed out of the ordinary course of ticket sales without reference to a specific event but permitting access to a basket of events and valid for a duration of time, then it partakes the character of voucher – instrument with obligation. When the ‘Pass’ loses its character as an ‘advance paid’ for a supply in future – whether to the Payer or any other bearer – and becomes an ‘instrument with obligation’, then the ‘Pass’ becomes a voucher.

* includes nominee of bearer-instruments

** becomes voucher on transfer of accumulated points before redemption

| Illustration | Voucher or Not | Nature of Instrument |

| Shopping gift card purchased for `5,000/- | Not voucher | It’s money, by way of ‘stored value’ even if not encashable |

| Coupons or token given to customer by pizza outlet on making purchase of `1,000/- which allows 10%discount on next purchase | Not voucher | It is future discount by way of ‘value-to-use’ not encashable |

| Money deposited into digital wallet | Not voucher | It’s money, by way of ‘stored value’ though encashable |

| Points credited into digital wallet Transfer of iability towards accumulated loyalty points credited to customers | Voucher | It is future discount by way of ‘value-to-use’ not encashable Now it’s become an ‘instrument with obligation’ |

| Pre-paid instruments: Ø Telephone calling card / recharge card Ø Multi-currency traveller’s card Ø DTH recharge card |

Not voucher | It’s money received in advance to be settled by making supplies in future |

| Non-instrument based advances: Ø Receipt issued to customer for acknowledging advance payment received towards PO issued Ø Advance booking of film ticket Ø Train ticket purchased in advance Ø Contribution of instalments into ‘gold savings scheme’ Ø Time-share in resort |

Not voucher | It’s money received in advance to be settled by making supplies in future |

The reason why it is important to differentiate whether it is a voucher or not, is that if the instrument is money that tax is payable on the actual ‘paid-in value’ and not the ‘value-to-use’ (or redeemable face value). For example, customer pays advance of `1,00,000 to distributor and the distributor transfers `80,000 to manufacture. GST payable by the distributor will be on `1,00,000 and the GST payable by the manufacturer it be on `80,000. Ignoring the fact that credit is not allowable, this would be the treatment in respect of any instrument that fits the definition of money. However, if a voucher was supplied by the manufacturer to the distributor of face value (or value-to-use) `1,00,000 but paid-in value `80,000, GST would be payable by the manufacturer on `1,00,000 and not `80,000. Further, anomalies arise on account of distributors liability to pay GST on `1,00,000 but with serious concerns on availability of credit of tax charged by manufacturer. Without satisfying conditions under section 16(2) read with rule 28, credit would not be available and tax would be collected on face value or value -to-use and not the actual paid-in value. Payment of tax in the case of vouchers on face value or value-to-use is found in rule 32(6).

It is important to understand that a similar provision as specified in relation to time of supply of goods also exists in time of supply of services. It is reasonable to, therefore, infer that the Government in its wisdom, in all probability, will treat ‘vouchers relating to goods’ and ‘vouchers relating to services’ as distinct and separate class of transactions. What does one understand by ‘vouchers relatable to goods’ and ‘vouchers relatable to services? A layman would comprehend that vouchers relatable to goods would be those class of transactionswhich can be exchanged for goods whereas vouchers relating to services being distinct and separate can be exchanged only for services. There can be a third class of transactions relating to vouchers, namely, a gift voucher issued by a bank which can be exchanged only for cash. But a plain reading of definition of goods and services indicates that they both exclude money. Therefore, such vouchers relatable to cash / money can be safely assumed to be outside the ambit of GST laws.

It is possible for one to construe that a voucher relating to goods can be embedded for the provision of services also. Such class of transactions must be read with Schedule II to understand whether they are to be treated as goods or as services and thereafter apply the principles laid down to the transaction as if they were goods or services. And in such situations, await until time of redemption to determine the rate of tax and class of supply. Interesting situations arise in respect of such transactions. For instance, the points accumulated in a credit card could be used to exchange for goods or issue of an air ticket. Difficulty arises in taxing such transactions in the hands of the person issuing such points. However, the taxability or otherwise of such accumulated points would need detailed deliberations based on facts and surrounding circumstances of each case.

As discussed above, the time of supply of goods in case of supply of vouchers by a supplier will be:

a) date of issue of voucher if the supply is identifiable at that point

b) date of redemption of voucher in all other cases

This basically means that if the exact nature of goods to be supplied along with its quantity value of such goods are available when the voucher is issued, the time of supply will be the date of issue of voucher. On the other hand, if the nature of supply of goods are not available at the time of issue of voucher, then the time of supply will be considered as the date of redemption of voucher. This is not to say that the time of supply will determine the value also. This is because as per Rule 32(6), the value will always be the redemption or face value of the voucher irrespective of the time of supply.