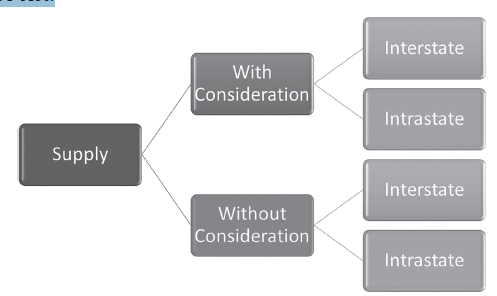

Transactions with consideration/without consideration :

Under GST, there are some transactions where they are still treated as supply even though there is no receipt of consideration on such transactions. Transactions which are required to be qualified as supply are given specifically in the Schedule I of the CGST Act.

All transactions where there is no consideration received should be identified accordingly in the GST Audit report and if there are any transactions which do not qualify, the same should be reported in the GST Audit report.

There is also a debate on the transactions related to amount levied / collected from employees like mess / food bills collected from them and paid to the vendor or collection of token amount on the re issue of ID card etc., all such transactions have to be identified and verified GST is collected on the same and reported in the GST returns accordingly, if not the same should be reported in the audit report All transactions where there is no consideration received should be identified accordingly in the GST Audit report and if there are any transactions which do not qualify, the same should be reported in the GST Audit report.

There is also a debate on the transactions related to amount levied / collected from employees like mess / food bills collected from them and paid to the vendor or collection of token amount on the re issue of ID card etc., all such transactions have to be identified and verified GST is collected on the same and reported in the GST returns accordingly, if not the same should be reported in the audit report and a provision for the non-payment of taxes along with interest has to be provided in the financial statements. Refer to the ruling provided by the Kerala AAR on the reimbursement of food expense of employees, where it has clearly said that GST is applicable on such transactions. Refer to AAR’s ruling from various states on similar cases and this will give an idea of how the department is working on the same.

If any transactions are found during the verification on which GST is not levied and are falling under the provision of supply and without consideration, the same should be reported in the Audit report.