Treatment of Reserves and Undistributed Profits on Retirement

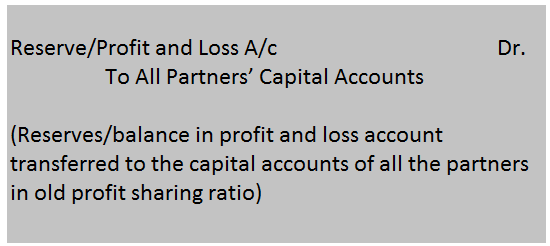

Before a partner retires, reserves created out of profits or balances in profit and loss account must be transferred to the capital accounts of all the partners in the ratio in which they share profits and losses at the time of retirement (old ratio). It is done so that the retiring partner may get his share of accumulated profits and may contribute his share of the loss that has not been transferred to capital accounts so far. The journal will be:

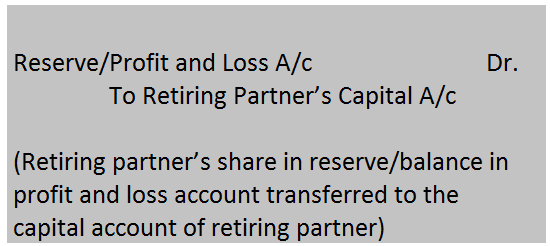

Alternative Method: Only the share of the retiring partner is credited to his capital account for his share of profit.