Two approaches for computing the assessable value :

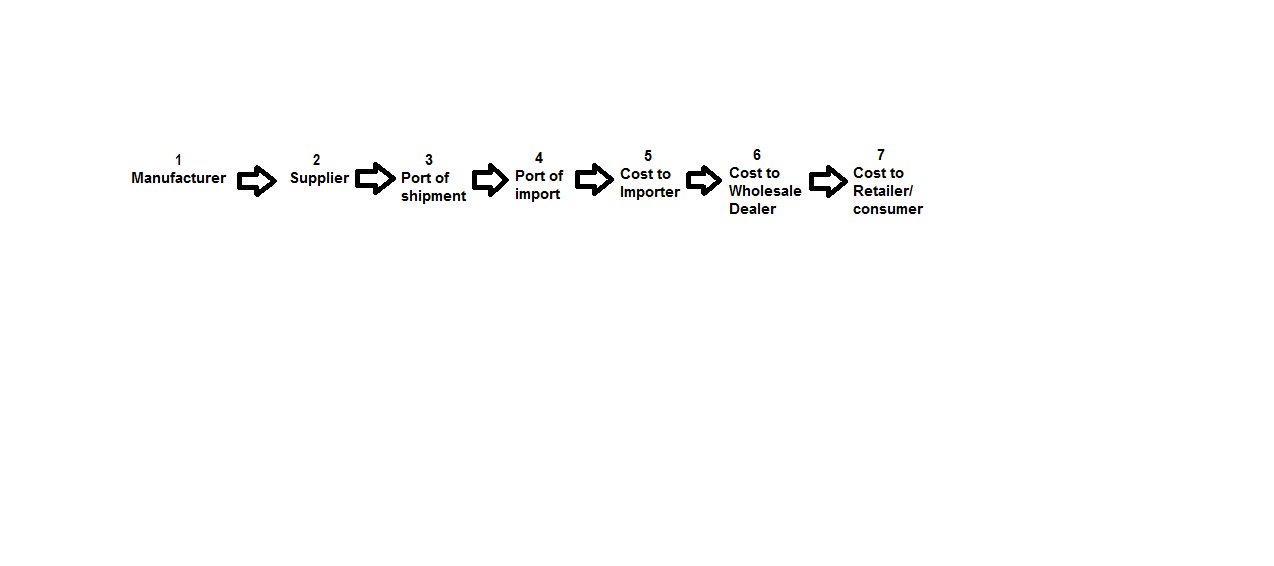

In the course of import, the goods take the following route.

Theoretically the value of the goods at stages (1) (2) (3) (5) (6) (7) is tangible and ascertainable. Furthermore, these values are documented and capable of verification by comparison with corresponding values for such or similar goods. The documents involved in such stages are

(i) Manufacturer‘s price list / quotation / sale invoices.

(ii) Supplier‘s sale invoices/ market prices

(iii) Customs approved attested documents showing value adopted for levy of export duty and allied controls.

(iv) Importer‘s account books

(v) Sale invoices issued by importer to the wholesale dealer or the next purchaser. Market trend of the prices of the goods.

(vi) Sale invoices of wholesale dealers; and trend of prices in the market.

The invoice values normally give CIF or FOB values of the goods. The market value is the wholesale market price at which the importers are regularly selling imported goods. These two are the tangible and readily available data, at the hands of the customs officers to arrive at the “assessable value” a notional deducted value of the goods.

Thus, two well accepted approaches have evolved:

(i) one starting from the actual whole sale market price of the goods in question and giving necessary abatements to adjust the post – importation costs;

(ii) the second, to take as base, the value given in the invoice and make necessary adjustments for factors influencing the price in individual transactions.