Two Types of Shares:

If a company issues both types of shares, Preference and Equity, the accounts will be prefixed by the terms ‘Preference Share’ or ‘Equity Share’ as the case may be.

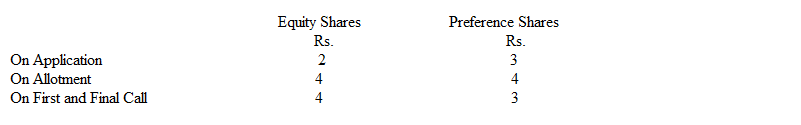

Priya Ltd. offer to the public 1,00,000 Equity Shares and 50,000 Preference Shares of Rs.10 each payable as under.

The public applied for 1,20,000 Equity Shares and 45,000 Preference Shares. Application for Preference Shares were accepted in full. All excess money received on equity shares was rejected. All money due was received. Pass entries, prepare important ledger accounts and extract from the Balance sheet.

Solution:

In the Books of Priya Ltd.

Journal Entries

| Date | Particulars | L.F. | Debit Rs. |

Credit Rs. |

| Bank A/c Dr | 2,40,000 | |||

| To Equity Share Application A/c | 2,40,000 | |||

| (Application money received on 1,20,000 Equity shares) | ||||

| Bank A/c Dr | 1,35,000 | |||

| To Preference Share Application A/c | 1,35,000 | |||

| (Application money received on 45,000 preference shares) | ||||

| Equity Share Application A/c Dr | 2,00,000 | |||

| To Equity Share Capital A/c | 2,00,000 | |||

| (Equity application money transferred to equity share capital) | ||||

| Preference share application A/c Dr | 1,35,000 | |||

| To Preference share capital A/c | 1,35,000 | |||

| (Preference share application money transferred to preference share capital) | ||||

| Equity Share Application A/c Dr | 40,000 | |||

| To Bank A/c | 40,000 | |||

| (Excess Equity share application money on 20,000 shares refunded) | ||||

| Equity Share allotment A/c Dr | 4,00,000 | |||

| to Equity Share capital | 4,00,000 | |||

| (Allotment money due on 1,00,000 Equity shares @ Rs.4 per share) | ||||

| Bank A/c Dr | 4,00,000 | |||

| To Equity Share Allotment A/c | 4,00,000 | |||

| (Allotment money received on equity shares) | ||||

| Preference share allotment A/c Dr | 1,80,000 | |||

| To Preference share capital A/c | 1,80,000 | |||

| (Allotment money on 45,000 preference shares due) | ||||

| Bank A/c Dr | 1,80,000 | |||

| To Preference share allotment A/c | 1,80,000 | |||

| (Allotment money received on preference shares) | ||||

| Equity First & Final call A/c Dr | 4,00,000 | |||

| To Equity Share capital A/c | 4,00,000 | |||

| (First & Final call amount due on 1,00,000 shares) | ||||

| Bank A/c Dr | 4,00,000 | |||

| To Equity Share First & Final call A/c 4,00,000 | 4,00,000 | |||

| (First & Final call amount received on equity shares) | ||||

| Preference Share First & Final call A/c Dr | 1,35,000 | |||

| To Preference Share capital A/c | 1,35,000 | |||

| (Preference First & Final call amount due on 45,000 shares @ 3) | ||||

| Bank A/c Dr | 1,35,000 | |||

| To Preference Share First & Final call A/c | 1,35,000 | |||

| (Amount received on Preference first & final call) | ||||

Equity Share Capital

| Particulars | Rs. | Particulars | Rs. |

| By Equity Share Application A/c | 2,00,000 | ||

| By Equity ShareAllotment A/c | 4,00,000 | ||

| To Balance c/d | 10,00,000 | By Equity First & Final call A/c | 4,00,000 |

| 10,00,000 | 10,00,000 | ||

| By Balance b/d | 10,00,000 |

Preference Share Capital

| Particulars | Rs. | Particulars | Rs. |

| By Preference Share Application A/c | 1,35,000 | ||

| By Preference Share Allotment A/c | 1,80,000 | ||

| To Balance c/d | 4,50,000 | By Preference Share First & Final call A/c | 1,35,000 |

| 4,50,000 | 4,50,000 | ||

| By Balance b/d | 4,50,000 |

Bank Account

| Particulars | Rs. | Particulars | Rs. |

| To Equity Share Allotment A/c | 2,40,000 | By Equity Share Application | 40,000 |

| To Preference Share Application A/c | 1,35,000 | ||

| To Equity Share Allotment A/c | 4,00,000 | ||

| To Preference Share | 1,80,000 | ||

| To Equity First & Final call A/c | 4,00,000 | ||

| To Preference First & Final call A/c | 1,35,000 | By Balance c/d | 14,50,000 |

| 14,90,000 | 14,90,000 | ||

| To Balance b/d | 14,50,000 |

Extracts from Balance Sheet Entries of Priya

| Liabilities | Rs. | Assets | Rs. |

| Share Capital: | |||

| Authorised: | —- | Current Assets: | |

| Issued : | Cash at Bank | 14,50,000 | |

| 50,000 Preference share | 5,00,000 | ||

| @Rs.10 each | |||

| 1,00,000 Equity share | 10,00,000 | ||

| @Rs.10 each | |||

| Subscribed : | |||

| 45000 Preference Shares | |||

| @ Rs.10 each | 4,50,000 | ||

| 100000 Equity shares | |||

| @ Rs.10 each | 10,00,000 | ||

| Called-up: | |||

| 45000 Preference Shares | |||

| @ Rs.10 each | 4,50,000 | ||

| 100000 Equity shares | |||

| @ Rs.10 each | 10,00,000 | ||

| Paid-up: | |||

| 45000 Preference Shares | |||

| @ Rs.10 each | 4,50,000 | ||

| 100000 Equity shares | |||

| @ Rs.10 each | 10,00,000 | ||

| 14,50,000 | 14,50,000 |

Illustration :

Thamarai Co. Ltd. issued 70,000 shares of Rs.10 each payable at a premium of Rs.2 per share.

Rs. 4 on application

Rs. 5 on Allotment

Rs. 2 on First Call

Re. 1 on Final Call

All the shares were duly subscribed. The money’s due on the shares were received except the First Call amount on 1,000 shares and the

Final Call amount on 1,500 shares.

The company forfeited the shares on which both the call amounts were not received. Of these 800 shares were reissued at Rs.7 per share.

Draft the necessary journal entries.

Solution:

Journal in the Books of Thamarai Co. Limited

| Bank A/c Dr | 96,000 | |||

| To Share Application A/c – 96,000 | 96,000 | |||

| (Share application money on 24000 applications received) | ||||

| Share Application A/c Dr | 64,000 | |||

| To Share Capital A/c 64,000 | ||||

| (The application money on 16,000 applications transferred to share capital account) | ||||

| Share Application A/c Dr | 19,200 | |||

| To Bank A/c – | 19,200 | |||

| (Excess application money refunded on 4,800 shares @ Rs.4)) | ||||

| Share application A/c Dr | 12,800 | |||

| To Share Allotment A/c – | 12,800 | |||

| (Excess application money transferred to share allotment A/c) | ||||

| Share allotment A/c Dr | 96,000 | |||

| To Share capital A/c – | 96,000 | |||

| (Allotment money on 16,000 shares) | ||||

| Bank A/c Dr | 83,200 | |||

| To Share allotment A/c | 83,200 | |||

| (Allotment money received ) | ||||

| Share first call A/c Dr | 80,000 | |||

| To Share capital A/c | 80,000 | |||

| (First call money due ) | ||||

| Bank A/c Dr | 80,000 | |||

| To Share first call A/c 80,000 | 80,000 | |||

| (First call money received ) | ||||

| Share second and final call A/c Dr | 80,000 | |||

| To Share capital A/c | 80,000 | |||

| (Second call money due ) | ||||

| Bank A/c Dr | 76,000 | |||

| To Share second and final call A/c | 76,000 | |||

| (Second call money received except on 800 shares) | ||||

| Share capital A/c Dr | 16,000 | |||

| To Share second & final call A/c | 4,000 | |||

| To Forfeited Shares A/c 12,000 | 12,000 | |||

| (800 shares forfeited on which final call money was not received) | ||||

| Bank A/c Dr | 14,400 | |||

| Forfeited Shares A/c Dr | 1,600 | |||

| To Share capital A/c | 16,000 | |||

| (800 shares reissued @ Rs.18) | ||||

| Forfeited Shares A/c Dr | 10,400 | |||

| To Capital reserve A/c | 10,400 | |||

| (Profit on forfeited and reissued shares transferred to capital reserve A/c) | ||||

Ledger in the books of Surya Ltd.

Dr. Bank Account Cr.

|

Particulars |

Rs. | Particulars |

Rs. |

| To Share Application A/c |

96,000 |

By Share Application A/c |

19,200 |

| To Share Allotment A/c |

83,200 |

By Balance c/d |

3,30,400 |

| To Share First Call A/c |

80,000 |

||

| To Share Second Call A/c |

76,000 |

||

| To Share Capital A/c |

14,400 |

||

|

3,49,600 |

3,49,600 |

||

| To Balance b/d |

3,30,400 |

Dr. Share Application Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Share Capital A/c To Bank A/c | 64,000 | By Bank A/c | 96,000 |

| To Share Allotment A/c | 19,200 | ||

| 12,800 | |||

| 96,000 | 96,000 |

Dr. Share Allotment Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Share Capital A/c | 96,000 | By Bank A/c | 83,200 |

| By Share Application A/c | 12,800 | ||

| 96,000 | 96,000 |

Dr. Share First Call Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Share Capital A/c | 80,000 | By Bank A/c | 80,000 |

| 80,000 | 80,000 |

Dr. Share Capital Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Share Capital A/c | 80,000 | By Bank A/c | 76,000 |

| By Share Capital A/c | 4,000 | ||

| 80,000 | 80,000 |

Dr. Share Capital Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Share second call A/c | 4,000 | By Share Application A/c | 64,000 |

| To Forfeited Shares A/c | 12,000 | By Share Allotment A/c | 96,000 |

| To Balance c/d | 3,20,000 | By Share First call A/c | 80,000 |

| By Shares Second call A/c | 80,000 | ||

| By Bank A/c | 14,400 | ||

| By Shares forfeited A/c | 1,600 | ||

| 3,36,000 | 3,36,000 | ||

| By Balance b/d | 3,20,000 |

Dr. Shares Forfeited Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Share Capital A/c | 1,600 | By Share Capital A/c | 12,000 |

| To Capital Reserve A/c | 10,400 | ||

| 12,000 | 12,000 |

Dr. Capital Reserve Account Cr.

| Particulars | Rs. | Particulars | Rs. |

| To Balance c/d | 10,400 | By Share Forfeited A/c | 10,400 |

| 10,400 | 10,400 | ||

| By Balance b/d | 10,400 |

Extracts from the Balance Sheet of Surya Ltd.

| Liabilities | Rs. | Assets | Rs. |

| Share Capital | Current Assets: | ||

| Authorised Capital | —- | Bank | 3,30,400 |

| Issued Capital | |||

| 16,000 shares @ Rs.20 each | 3,20,000 | ||

| Subscribed Capital | |||

| 16,000 shares @ Rs.20 each | 3,20,000 | ||

| Called-up Capital | |||

| 16,000 shares @ Rs.20 each | 3,20,000 | ||

| Paid up Capital | |||

| 16,000 shares @ Rs.20 each | 3,20,000 | ||

| Reserves and surplus: | |||

| Capital reserve | 10,400 | ||

| 3,30,400 | 3,30,400 |