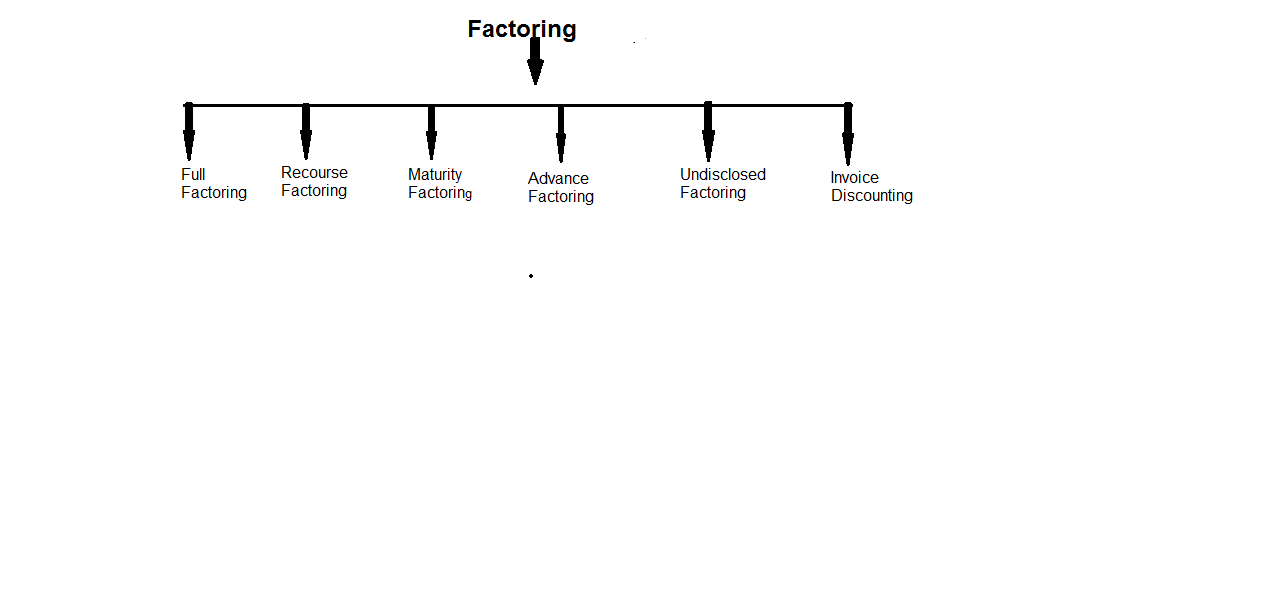

TYPES OF FACTORING :

Non-Recourse or Full factoring

Under this type of factoring the bank takes all the risk and bear all the loss in case of debts becoming bad debts.

Recourse Factoring

Under this type of factoring the bank purchases the receivables on the condition that any loss arising out or bad debts will be borne by the company which has taken factoring.

Maturity Factoring

Under this type of factoring bank does not give any advance to the company rather bank collects it from

customers

and pays to the company either on the date of collection from the customers or on a guaranteed payment date.

Advance Factoring

Under advance factoring arrangement the factor provides an advance against the uncollected and non-due receivables to the firm.

Undisclosed Factoring

Under this type of factoring, the customer is not informed of the factoring arrangement. The firm may collect dues from the customer on its own or instruct to make remit once at some other address.

Invoice Discounting

Under this type of factoring the bank provide an advance to the company against the account receivables and in

turn charges interest rate from the company for the payment which bank has given to the company