Valuation of taxable services for charging service tax [Section 67] :

Section 67 provides for the valuation of taxable services. The provisions of this section are discussed below:

(1) Consideration in terms of money: If the consideration for a taxable service is in terms of money, the value of such service shall be the gross amount charged by the service provider for such service provided or to be provided by him.

(2) Consideration not wholly or partly in terms of money: If the consideration for a taxable service is not wholly or partly in terms of money, then the value of such service shall be such amount in money, with the addition of service tax charged, is equivalent to the consideration.

(3) Consideration not ascertainable: If the consideration for a taxable service is not ascertainable, the value of such service shall be the amount as may be determined in the prescribed manner.

(4) Where the gross amount charged is inclusive of service tax payable: Where the gross amount charged by a service provider, for the service provided or to be provided is inclusive of service tax payable, the value of such taxable service shall be such amount as, with the addition of tax payable, is equal to the gross amount charged.

| Illustration

Rishabh provides a taxable service to Padam for a consideration of Rs 10,000 inclusive of service tax at 14%. The value, in such case, shall be computed as 10,000 / 1.14 or [ 10,000 * 100 / 114 ] = RS 8,772.

|

(5) Gross amount charged includes amount received before/during/after the provision of such service: The gross amount charged for the taxable service shall include any amount received towards the taxable service either before, during or after the provision of such service.

(6) Subject to the aforementioned provisions, the value of a taxable service shall be determined in such manner as may be prescribed [prescribed in the Service Tax (Determination of Value) Rules, 2006].

| 1. Gross amount charged includes payment by cheque, credit card, deduction from account and any form of payment by issue of credit notes or debit notes and book adjustment, and any amount credited or debited, as the case may be, to any account, whether called “suspense account” or by any other name, in the books of account of a person liable to pay service tax, where the transaction of taxable service is with any associated enterprise.

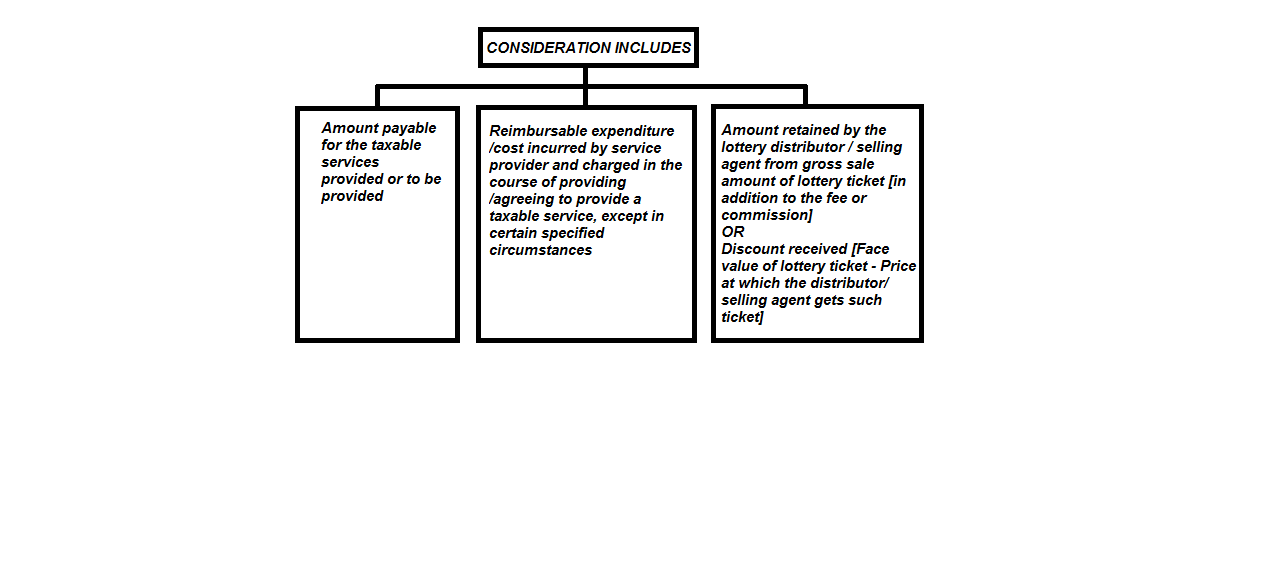

2. Consideration includes– (i) any amount that is payable for the taxable services provided or to be provided; (ii) any reimbursable expenditure or cost incurred by the service provider and charged, in the course of providing or agreeing to provide a taxable service, except in such circumstances, and subject to such conditions, as may be prescribed; (iii) any amount retained by the lottery distributor or selling agent from gross sale amount of lottery ticket in addition to the fee or commission, if any, or, as the case may be, the discount received, that is to say, the difference in the face value of lottery ticket and the price at which the distributor or selling agent gets such ticket. |