Various aspects of the Primary Market issues :

A merchant banker is the main facilitator for public issues. The issuer company makes detailed disclosures as per the SEBI Disclosure and Investor Protection (DIP) guidelines in its offer document while offering it for subscription. The merchant bankers are the specialized intermediaries who have to ensure after proper due diligence that all required disclosure and investor protection guidelines are complied with, at the time of submission of draft offer documents to SEBI. If a merchant banker fails to ensure compliance, the merchant banker would be penalized by SEBI in term of SEBI (Merchant Bankers) Regulations. The draft offer document filed by the merchant banker is also placed on the website for public comments. SEBI’s officials at various levels check the details and ensure that all necessary material information is disclosed in the draft offer documents.

Offer Document

In case of public issue, an offer document is called as prospectus. It is called as offer for sale and Letter of Offer in case of a rights issue. These offer documents need to be filed with Registrar of Companies (ROC) another facilitator. These offer documents also need to be filed with the concerned stock exchanges.

Red Herring Prospectus (RHP):

It is a prospectus which does not have details of share price or number of shares being offered or the amount of issue. If the price is not indicated, then the number of shares and the upper and lower price bands are disclosed. In the case of book building issues, it is a process of price discovery. In such a situation the price would not be determined until the bidding process is completed. Only on completion of the bidding process, the details of the final price are included in the offer document. Thereafter, the offer document is filed with ROC which is called a prospectus.

An offer document is an important document highlighting all the relevant information to assist an investor to make his/her investment decision about the company.

Pricing of the Issue:

As per SEBI’s guidelines the price for an issue is to be determined by the issuing company in consultation with the lead merchant banker. Either of the two prices (a) fixed price or (b) floor price or a price band (final price is determined based on the market forces)

Book Building:

It is a process undertaken by the company based on the demand for the securities to be issued. It is an alternative to the traditional fixed price method of security issue . The price for the proposed issue of securities is fixed based on the bids received for the number of securities (shares) offered for subscription by the issuing company. It is an opportunity for the market to discover the price for securities. As per the guidelines of SEBI, in the book building process, certain portion of issue are allocated for Retail Individual Investors, Non Institutional Investors and Qualified Institutional Buyers. Retail investor is an investor who applies or bids for securities (shares) of or for a value not more than Rs. 2,00,000.

Book building involves the following steps :

1. The company plans an IPO via the book building route.

2. The company appoints an issue manager (usually a merchant banker) as book –runner.

3. The company issues a draft prospectus containing all required disclosures

4. The draft prospectus is filed with SEBI

5. The issue manager (book runner) appoints syndicate members and other registered intermediaries to garner subscription

6. Price discovery begins through the bidding process

7. At the close of bidding , book –runner and company decide upon the allocation and allotments.

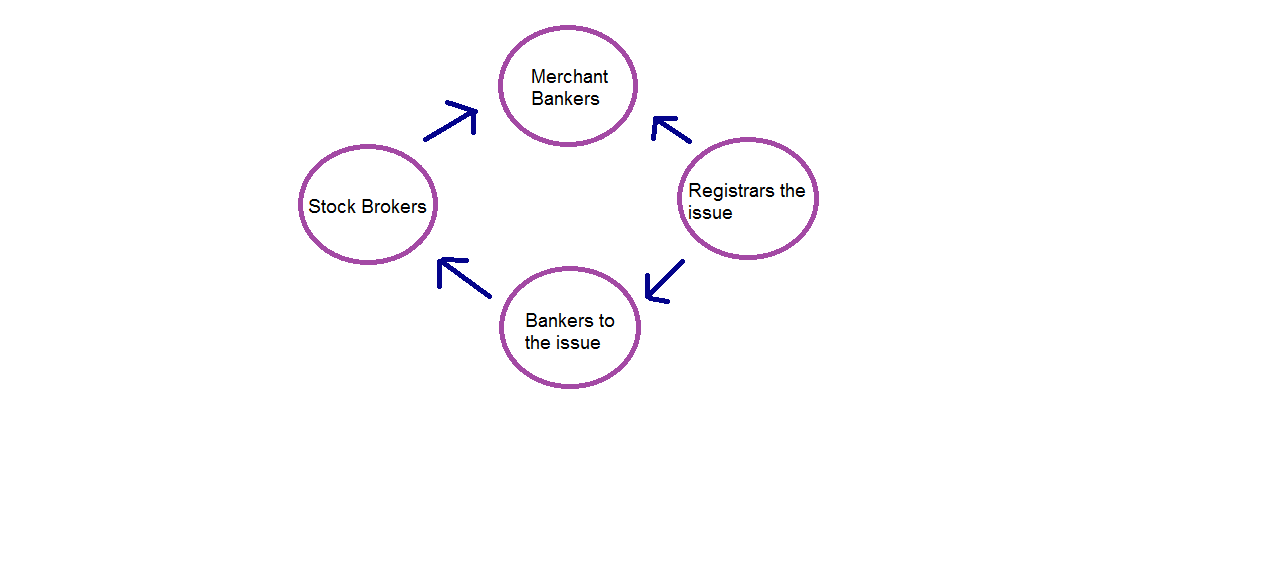

Important facilitators in the primary market issues are:

(a) Merchant Bankers to the issue or Book Running Lead Managers (BRLM)

(b) Syndicate Members

(c) Registrars to the issue

(d) Bankers to the issue

(e) Underwriters to the issue

(f) Auditors to the company

Merchant Banker/Book Running Lead Manager (BRLM):

A merchant banker needs to be registered with SEBI in accordance with the SEBI (Merchant Bankers) Regulations 1992 to act as a BRLM for an issue. In the pre-issue process, the Lead Manager (LM) takes up the due diligence of company’s operations/ management/ business plans/ legal etc. Other activities of the LM include drafting and design of Offer documents, Prospectus, statutory advertisements and memorandum containing salient features of the Prospectus. The BRLMs ensure compliance with stipulated requirements and completion of prescribed formalities with the Stock Exchanges, RoC and SEBI including finalization of Prospectus and RoC filing. Appointment of other intermediaries viz., Registrar(s), Printers, Advertising Agency and Bankers to the Offer is also included in the preissue processes. The LM also draws up the various marketing strategies for the issue. The post issue activities including management of escrow accounts, coordinate non-institutional allocation, intimation of allocation and dispatch of refunds to bidders etc are performed by the LM. The post Offer activities for the Offer will involve essential follow-up steps, which include the finalization of trading and dealing of instruments and dispatch of certificates and demat of delivery of shares, with the various agencies connected with the work such as the Registrar(s) to the Offer and Bankers to the Offer and the bank handling refund business.

A merchant banker is required to do the necessary due diligence in case of QIP mechanism.

Secondary Market

Once the securities are issued in the primary market and/or listed in the Stock Exchange, these can be traded in a market called the Secondary Market. Secondary market is a platform for the investors to buy and sell the securities.

Securities and Exchange Board of India (SEBI)

The establishment of the Securities and Exchange Board of India (SEBI) on the lines of the Securities and Investment Board of the UK, is a major development in the Indian capital market. SEBI which was established on the April 12th, 1988 is required to take a holistic view of the Indian securities markets. SEBI is required to regulate and promote the securities market by :

1. Providing fair dealings in the issues of securities and ensuring a market place where funds can be raised at a relatively low cost.

2. Providing a degree of protection to the investors and safeguard their rights and interests so that there is a steady flow of savingsinto the market

3. Regulating and developing a code of conduct and fair practices by intermediaries in the capital market like brokers and merchant banks with a view to making them competitive and professional.

Instruments – Capital Market

Equity Shares:

The equity holder, popularly known as share holder is the part owner of the company. Depending upon the pattern of the share holding, the equity holder is entitled for dividends, and voting rights as members of the company. These shares can be obtained either through the Initial Public Offering (IPOs), Further/Follow-on Public Offering (FPOs) (primary markets) and can also be bought in the stock markets after the stocks are listed (Secondary markets)

They provide permanent capital in the company .

Rights Issue (RIs):

When a listed company wants to raise funds from the markets, one option available to the corporate is to arrange to issue additional/fresh stocks (shares/debentures) to the existing stock holders, known as Rights Issue. Rights Issues are offered to the existing shareholders whose names appear on a record date and in a particular ratio to the number of securities held by the shareholder.The law in India requires that the new ordinary shares must be first issued to the existing shareholders on a pro rata basis.Shareholders through a special resolution can forfeit this pre-emptive right. Obviously , this will dilute their ownership.

Preference Shares:

The investors who hold the preference shares enjoy the following: (a) entitled for fixed dividend over other equity share holders. (b) In case of surplus, preference is given in distribution of income, over r equity share holders (c) In case of liquidation, their claims would rank above the equity share holders but only after the company’s creditors, bond and debenture holders.. However, the preference share holders do not have the right to vote. Companies in India can issue redeemable preference shares, but they can’t issue irredeemable preference shares.

Debentures:

One of the options available for an investor is to invest in a company’s debentures. A debenture holder enjoys a fixed rate of interest payable every half year/year, on a fixed date. The principal amount is repayable on the date of redemption. Debenture holders are creditors of the company.Debentures may be secured or unsecured .Secured debentures are also known as bonds

The interest charges are treated as deductible expenses in the hands of the company.

Bonds:

A bond is issued in the form of a negotiable certificate/ documents against indebtedness.

Bonds can be classified differently as per their characteristics, viz., as coupon, zero coupon, and convertible and non-convertible etc.

Coupon Bonds:

When an investor invests in a bond, he gets his return on investment, based on the coupon rate (interest at a pre fixed rate).

Zero Coupon Bonds:

A bond which is issued at a discount and repaid at a face value is called a Zero Coupon Bond. No periodic interest is payable. The investor on the date of Redemption gets the face value of the bond and the difference between the face value and the issue price, is the return on investment for the investor.

Convertible Bonds:

The investor gets an option to convert the bond into equity at a fixed conversion price.

Non-convertible Bonds:

The investor does not have the option to convert the bond into equity.

Commercial Paper (CP):

Commercial papers are issued by companies with high credit ratings, in the form of promissory notes, at discount but repayable at par, to their holder at maturity. Commercial papers are money market instruments and issued as per the guidelines of the Reserve Bank of India.

Certificate of Deposit (CD):

A certificate of deposit (which is also a money market instrument) is issued by a bank. It is issued at discount to be redeemable at par on the maturity date. The minimum investment is Rs100,000. It is issued for a minimum period of 7 days up to a maximum period of one year. It is issued in the form of usance promissory note. The CDs can be traded in the market from the date of issue. The CDs are issued as per the guidelines of the Reserve Bank of India.