WORKING PAPERS :

Audit working papers are the documents prepared or obtained by the auditors and retained by him in connection with the audit. Audit working papers are used to support the audit work done in order to provide assurance that the audit was performed in accordance with the relevant auditing standards. Working papers include all the evidence gathered by auditor indicating what work has been done by him and the procedure he has followed in verifying a particular asset or a liability and also provide information that whether:

– audit was properly planned;

– audit was carried out;

– audit was adequately supervised;

– the appropriate review was undertaken;

– the evidence is sufficient and appropriate to support the audit opinion.

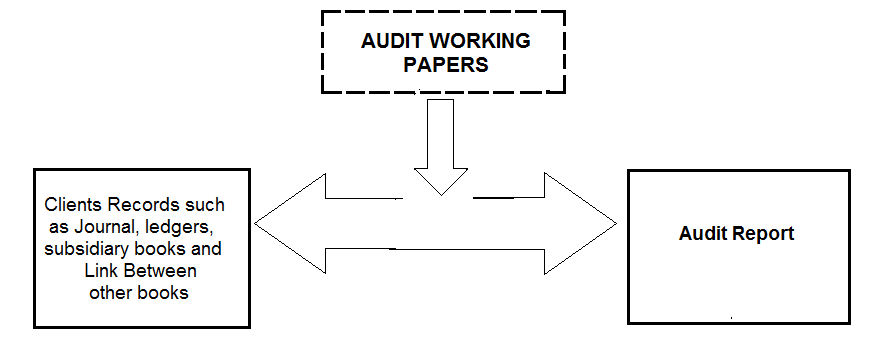

Working papers are the connecting link between the client’s records and the audited accounts. These provide permanent historical record. These also serve as a great guide to the staff to whom the work of audit has been assigned after the previous year audit. These would come to the help of the auditor in future in case the client files a suit against the auditor’s negligence. The working papers are the property of the auditor and the client cannot ask the auditor for their custody. However it is the duty of the auditor to maintain confidentiality of the client information. Further, if audit working papers are disclosed than it will amount to professional misconduct.